Consolidation heats up for maturing US shale

Growth might not be on the table, but operators are eyeing opportunities to add quality acreage

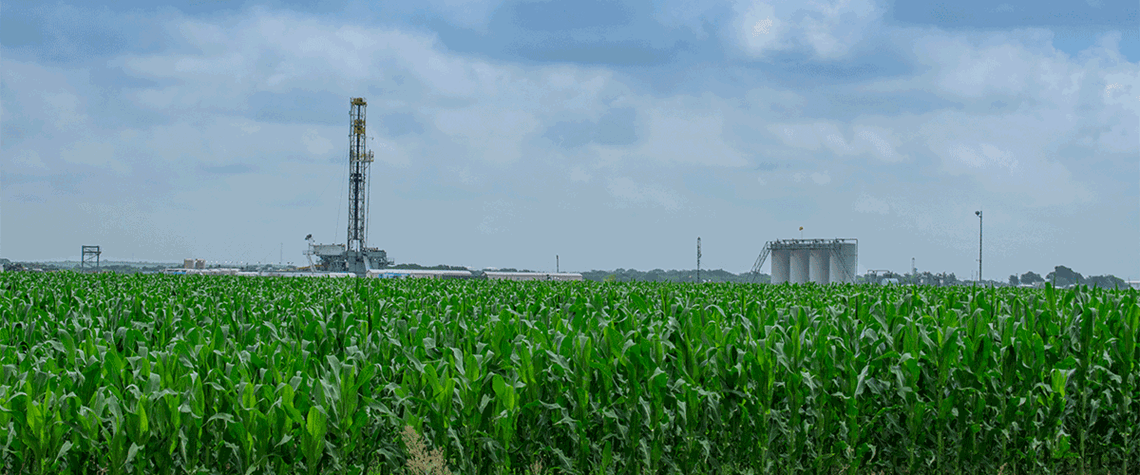

Lack of midstream capacity and dismal upstream growth prospects for 2023 are proving no barrier to M&A activity for maturing US shale basins. Over the past quarter, both the Eagle Ford and Appalachia recorded bumper deals that showcase the perceived long-term potential among operators. In the Eagle Ford, US independent Devon Energy snapped up Texas-focused Validus Energy for $1.8bn last year. The deal doubled the firm’s production base in the basin and increased exposure and access to Gulf Coast pricing. In July, the operator also added a bolt-on acquisition in the Williston basin but stressed there was not likely to be further spending in the immediate future. Other operators soon fo

Also in this section

18 February 2026

With Texas LNG approaching financial close, Alaska LNG advancing towards a phased buildout and Magnolia LNG positioned for future optionality, Glenfarne CEO Brendan Duval says the coming year will demonstrate how the company’s more focused, owner-operator approach is reshaping LNG infrastructure development in the North America

18 February 2026

The global gas industry is no longer on the backfoot, hesitantly justifying the value of its product, but has greater confidence in gas remaining a core part of the global energy mix for decades

18 February 2026

With marketable supply unlikely to grow significantly and limited scope for pipeline imports, Brazil is expected to continue relying on LNG to cover supply shortfalls, Ieda Gomes, senior adviser of Brazilian thinktank FGV Energia,

tells Petroleum Economist

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”