Consolidation heats up for maturing US shale

Growth might not be on the table, but operators are eyeing opportunities to add quality acreage

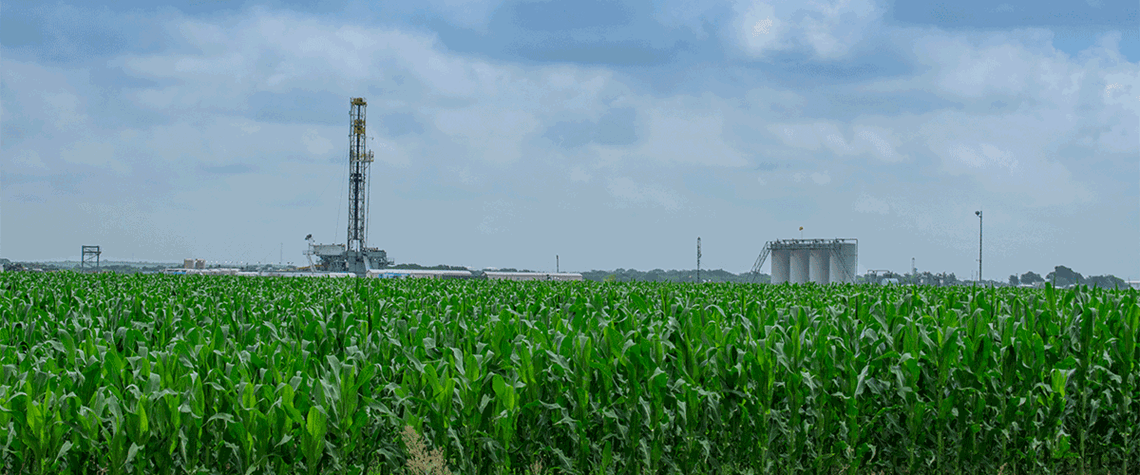

Lack of midstream capacity and dismal upstream growth prospects for 2023 are proving no barrier to M&A activity for maturing US shale basins. Over the past quarter, both the Eagle Ford and Appalachia recorded bumper deals that showcase the perceived long-term potential among operators. In the Eagle Ford, US independent Devon Energy snapped up Texas-focused Validus Energy for $1.8bn last year. The deal doubled the firm’s production base in the basin and increased exposure and access to Gulf Coast pricing. In July, the operator also added a bolt-on acquisition in the Williston basin but stressed there was not likely to be further spending in the immediate future. Other operators soon fo

Also in this section

11 March 2026

De la Rey Venter, CEO of LNG player MidOcean Energy, discusses strategy, project developments and the prospects for the LNG market

10 March 2026

From Venezuela to Hormuz, the US—backed by the most powerful military force ever assembled—is redrawing not only oil and gas flows but also the global balance of energy power

10 March 2026

By shutting the Strait of Hormuz, Iran has cut exports of distillate-rich Middle Eastern crude, jet fuel and diesel, and is holding the energy market hostage

10 March 2026

Eni’s director for global gas and LNG portfolio, Cristian Signoretto, discusses how demand will respond to rising LNG supply, and how the company is expanding its own gas and LNG operations through disciplined, capital-efficient investments