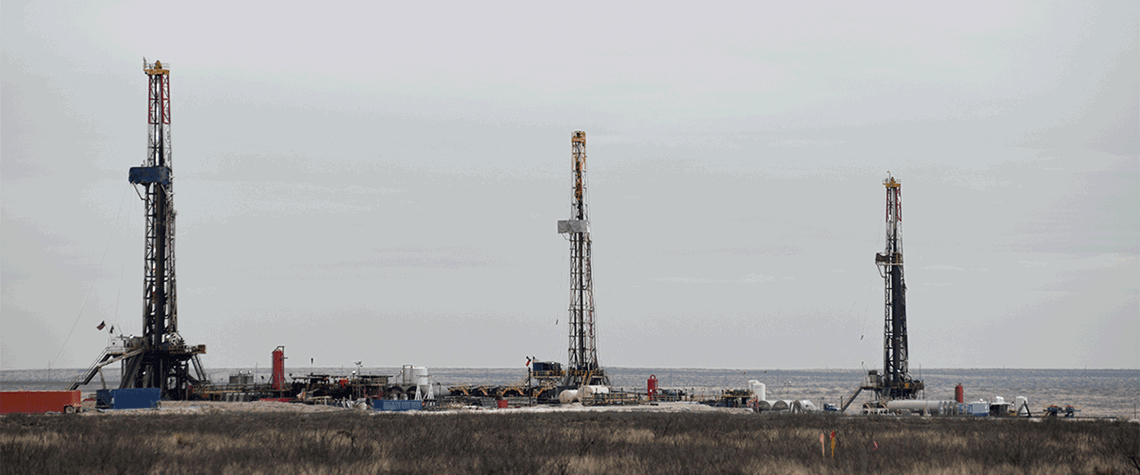

US shale starts 2023 in ‘realistic’ mood

First-quarter shale results show ongoing restraint amid signs of cost deflation

The first-quarter earnings season has highlighted signs of improved capital spending in the US, while certain tight oil producers have flagged up signs of cost deflation in oilfield services and equipment. Meanwhile, lower gas prices have caused producers in gas-rich basins to scale back operations, while oil prices—which have also declined since 2022—remain strong enough to support activity. Consultancy Wood Mackenzie notes in a report rounding up results among 42 US independents that WTI prices averaged $76/bl in the first quarter of 2023. This is “much closer to a ‘mid-cycle’ level than last year’s average of $96/bl”, it says. “Mid-cycle is not a hard and fast number, but that is generall

Also in this section

26 April 2024

While the US has been breaking records for its premium grade crude, there are doubts over whether you can have too much of a good thing

26 April 2024

Slowing demand growth and capacity expansions will squeeze refiners in coming years

25 April 2024

Some companies with assets in Israel have turned towards Egypt as tensions escalate, but others are holding firm despite rising tensions

24 April 2024

But even planned exploration activity is unlikely to reverse declining output from mature fields