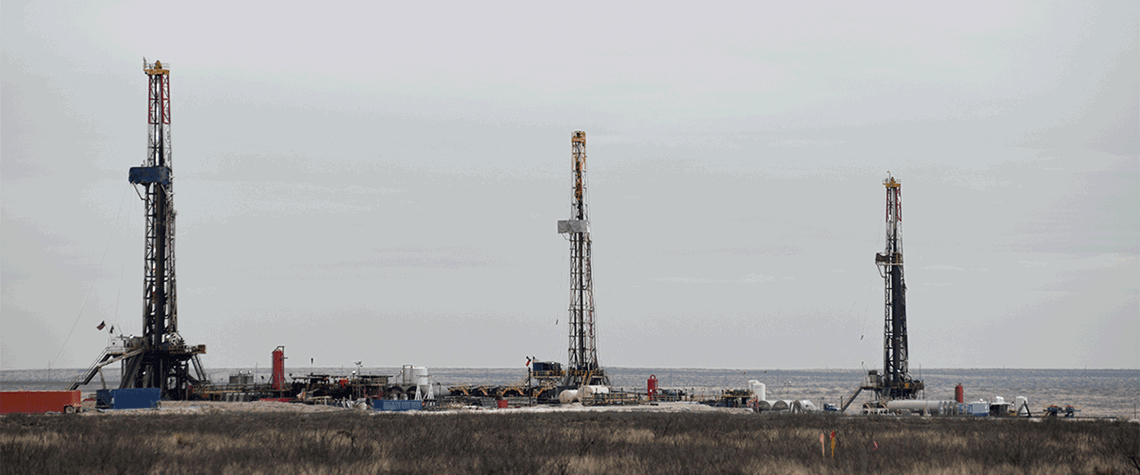

US shale starts 2023 in ‘realistic’ mood

First-quarter shale results show ongoing restraint amid signs of cost deflation

The first-quarter earnings season has highlighted signs of improved capital spending in the US, while certain tight oil producers have flagged up signs of cost deflation in oilfield services and equipment. Meanwhile, lower gas prices have caused producers in gas-rich basins to scale back operations, while oil prices—which have also declined since 2022—remain strong enough to support activity. Consultancy Wood Mackenzie notes in a report rounding up results among 42 US independents that WTI prices averaged $76/bl in the first quarter of 2023. This is “much closer to a ‘mid-cycle’ level than last year’s average of $96/bl”, it says. “Mid-cycle is not a hard and fast number, but that is generall

Also in this section

10 March 2026

From Venezuela to Hormuz, the US—backed by the most powerful military force ever assembled—is redrawing not only oil and gas flows but also the global balance of energy power

10 March 2026

By shutting the Strait of Hormuz, Iran has cut exports of distillate-rich Middle Eastern crude, jet fuel and diesel, and is holding the energy market hostage

10 March 2026

Eni’s director for global gas and LNG portfolio, Cristian Signoretto, discusses how demand will respond to rising LNG supply, and how the company is expanding its own gas and LNG operations through disciplined, capital-efficient investments

9 March 2026

Petroleum Economist analysis sees increases in output from Saudi Arabia, Venezuela and Kazakhstan among others before region’s murky descent