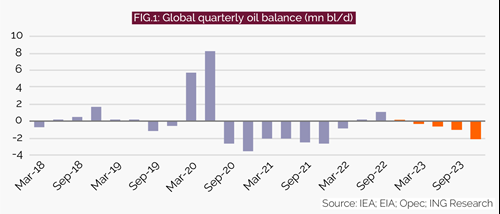

We expect the oil market to be in deficit through 2023 (see Fig.1), which should see oil prices move higher. We forecast Ice Brent to average $104/bl next year.

Russian oil exports have proved to be more stubborn this year than expected. While oil bans and self-sanctioning from a handful of buyers have certainly had an impact on flows, the willingness of other buyers to pick up discounted Russian crude oil has largely offset reductions elsewhere.

China’s share of Russian crude oil imports increased from 15pc over the first nine months of 2021 to more than 17pc over the same period this year. Meanwhile, India, which has historically been a minimal buyer of Russian oil, has increased purchases significantly since the war—with imports from Russia approaching 1mn bl/d in recent months.

More to come

However, the largest disruption to oil flows still lies ahead. The EU, which is the largest buyer of Russian oil, is set to see a ban on seaborne imports from Russia come into force in early December for crude oil and early February for refined products. The big question is whether China, India and a handful of other buyers are willing and able to pick up this oil.

Their ability to absorb significantly more Russian oil is likely limited, so we believe Russian supply will have to fall more aggressively. We are assuming Russian supply falls by a little more than 2mn bl/d in 2023.

The other unknown is how successful the G7 price cap on Russian oil will be, if and when it is implemented. It will be difficult to convince big buyers to follow the cap, and there is always the risk that Russia reduces supply as a result. This would have the opposite effect of what is intended with the price cap.

Opec+ surprised the market with the magnitude of its announced supply cuts in October. The group agreed to reduce production targets by 2mn bl/d from August 2022 target levels, in response to concerns over demand. The cuts will run from November until the end of 2023.

However, given the bulk of producers are pumping well below their target levels, the actual supply cut will be c.1.1mn bl/d. While this is significantly below the headline number, it is still enough to dramatically change the outlook for the oil market in 2023. We had initially expected the market to be in small surplus over the first half of the year. However, lower Opec+ supply pushes the market firmly into deficit in 2023.

Muted US response

The response from US producers to the higher price environment has been underwhelming. US crude supply is forecast to grow by c.500,000bl/d this year to average 11.74mn bl/d, while output in 2023 is set to grow by a little more than 600,000bl/d, to average 12.35mn bl/d. This growth is significantly below what the industry has achieved in previous upcycles. For example, as recently as 2018, US crude output grew by 1.6mn bl/d year-on-year after WTI traded from $42/bl in June 2017 to as high as $76/bl in October 2018.

The lack of response from the US industry also appears to have given Opec+ the confidence to cut supply without the fear of losing market share to non-Opec producers, as seen in previous years.

It is becoming increasingly clear that the days of US producers pumping as much as they can are well and truly behind us. Instead, the top priority of the industry is maximising shareholder returns and, with that, showing restraint when it comes to capex.

Demand has disappointed this year due to Covid-related lockdowns in China, while higher prices have also played a role. Oil demand is expected to grow by almost 2mn bl/d this year to average 99.6mn bl/d, which would keep it just below pre-Covid levels. The outlook for demand through 2023 is becoming increasingly uncertain as the macro picture deteriorates. For now, oil demand is forecast to grow by 1.7mn bl/d, but there is downside risk given the global macro picture, along with uncertainty around China’s zero-Covid policy. A large share of demand growth next year is driven by expectations of a recovery in Chinese demand.

Where is the floor?

Despite the bullish outlook, it is still worth identifying where the floor for the market could be. The US administration has made it clear it will look to start refilling strategic petroleum reserves—which were heavily tapped into this year—should WTI trade down to c.$70/bl. This should provide a solid floor to the market. But we could see Opec+ intervene before the market has the opportunity to trade down to these levels.

Warren Patterson is head of commodities strategy for Amsterdam-headquartered bank ING.

This article is part of the upcoming special report Outlook 2023, which features expectations from the energy industry for key trends in the year ahead. Sign up here to receive updates about the full report.

Comments