21 March 2018

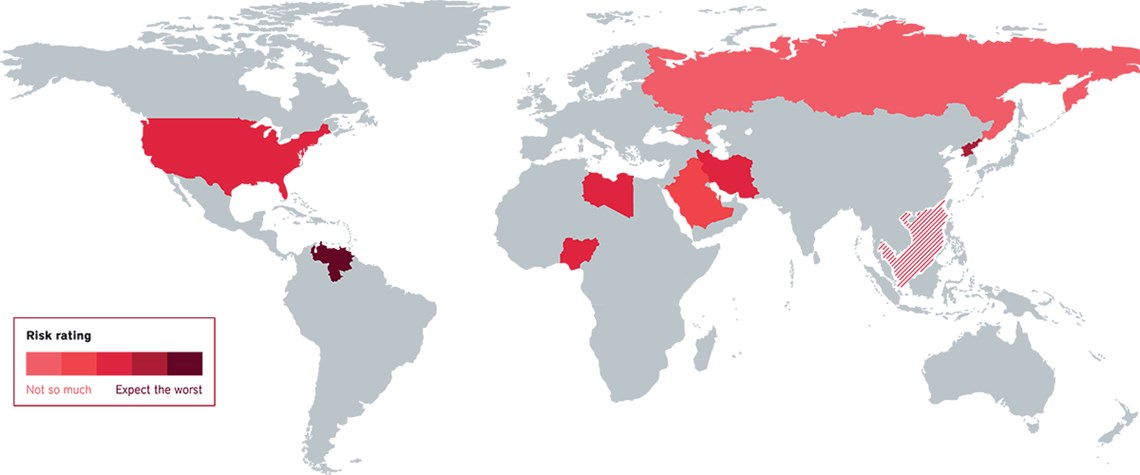

The volatile 10

As the oil market regains balance, risk will affect the price. Here's where to watch

US Unpredictable leader? Global risk now emanates directly from the Oval Office and—on everything from North Korea to Nafta—Donald Trump's Twitter account. For the oil market, the president is broadly bullish. US tax cuts may feed into higher demand; Trump's dislike of the Iran deal and stance on Venezuela may bring sanctions; and an implicit soft-dollar policy could support oil prices. His "American first" programme has not caused the drop in global trade some feared. The main bearish risk from the US comes from the Fed's planned interest-rate rises this year and the impact on the global economy. If Democrats win bigly in November's midterm elections, Trump will be stymied and the Russia in

Also in this section

18 February 2026

With Texas LNG approaching financial close, Alaska LNG advancing towards a phased buildout and Magnolia LNG positioned for future optionality, Glenfarne CEO Brendan Duval says the coming year will demonstrate how the company’s more focused, owner-operator approach is reshaping LNG infrastructure development in the North America

18 February 2026

The global gas industry is no longer on the backfoot, hesitantly justifying the value of its product, but has greater confidence in gas remaining a core part of the global energy mix for decades

18 February 2026

With marketable supply unlikely to grow significantly and limited scope for pipeline imports, Brazil is expected to continue relying on LNG to cover supply shortfalls, Ieda Gomes, senior adviser of Brazilian thinktank FGV Energia,

tells Petroleum Economist

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”