Outlook 2024: LNG investment - Hydrocarbon challenges or green opportunity?

Many LNG projects already incorporate emissions mitigation methods, hastening adoption for future projects

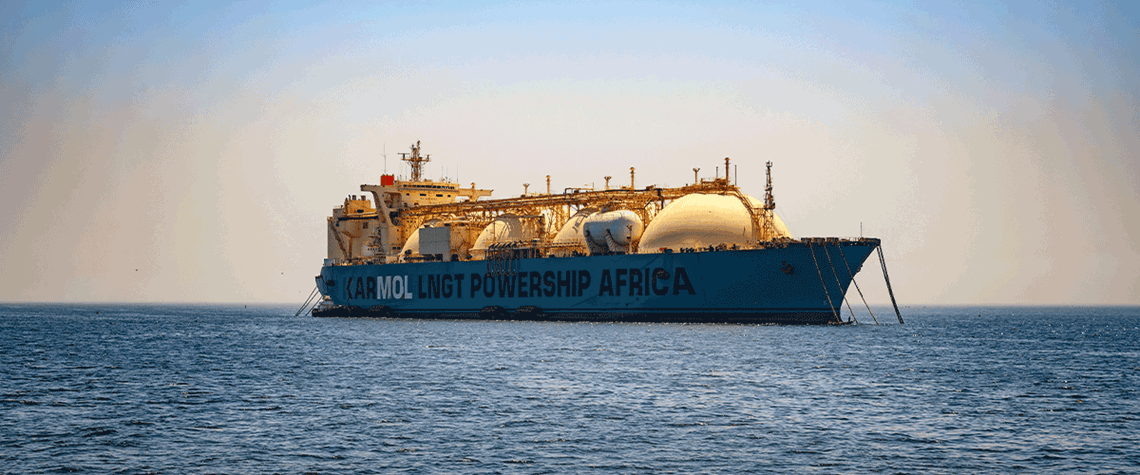

This decade’s unprecedented LNG supply investment is strongly focused on managing emissions intensity. Wide-ranging measures, particularly CCS, renewable-energy-powered liquefaction trains, carbon offsets and FLNG conversions, are being aggressively rolled out globally. While previous cycles of LNG production growth focused on the environmental benefits of offsetting buyers’ coal demand and shippers’ liquid fuel usage, supply projects are now under the greenhouse gas (GHG) microscope. Geopolitics and supply under-investment combined to push LNG spot prices to record highs in 2022 and c.$20/m Btu this winter. While LNG cargos will remain scarce until 2026, new trains, mainly in the US and Qat

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026