Equinor streamlines its offshore strategy

Exploration is providing mixed fortunes for IOCs amid higher costs, prompting firms to look towards M&A and safer plays

Norway’s Equinor has seen mixed fortunes from its offshore exploration in recent months, exemplifying a trend among IOCs that has seen recent high-profile successes coming alongside failures and setbacks—serving as a reminder that offshore exploration is risky. Domestically, Equinor’s exploration efforts in 2024 include drilling a dry hole at Harden sor, the sixth well to be drilled in production licence (PL) 248C in the Norwegian North Sea. This was followed by the firm delineating the Heisenberg oil and gas discovery in wells 35/10-11 S and A and also proving the presence of oil in the Hummer prospect—the first and second wells drilled in PL 827 SB. “Equinor’s performance in Norway has gen

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

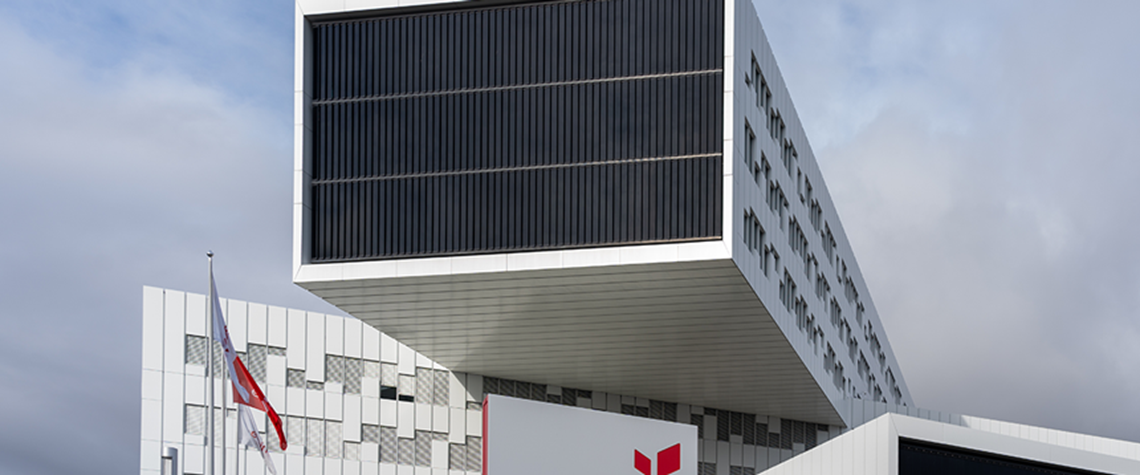

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026