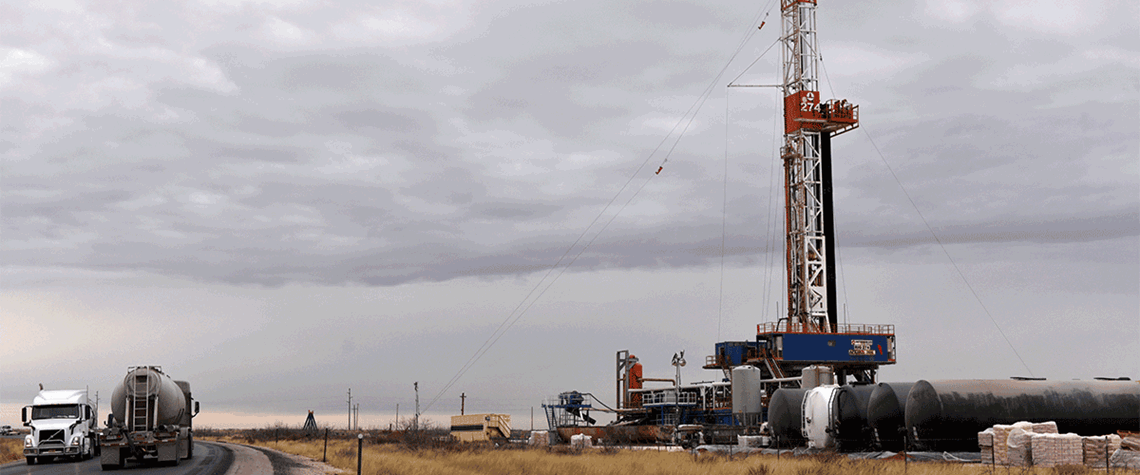

US shale response to oil price boost may be muted

Behind the rig count data lie differences between public and private operators, acreage questions, the lure of returns and unwavering capital discipline

The US’ active oil and gas rig count has generally been trending downwards since the end of April even as crude prices have been creeping up in recent weeks after holding relatively steady earlier in the year. The combined oil and gas rig count fell from 755 on 28 April to 641 on 15 September, according to Baker Hughes, with oil-focused rigs declining from 591 to 515. However, the Baker Hughes data from the latest three weeks in that period suggest the decline may be turning, with the total count falling by only one, to 631, with the total count fluctuating between 632 and 631 for three weeks before rising to 641, though it remains to be seen whether this will hold. Oil rig counts typically

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026