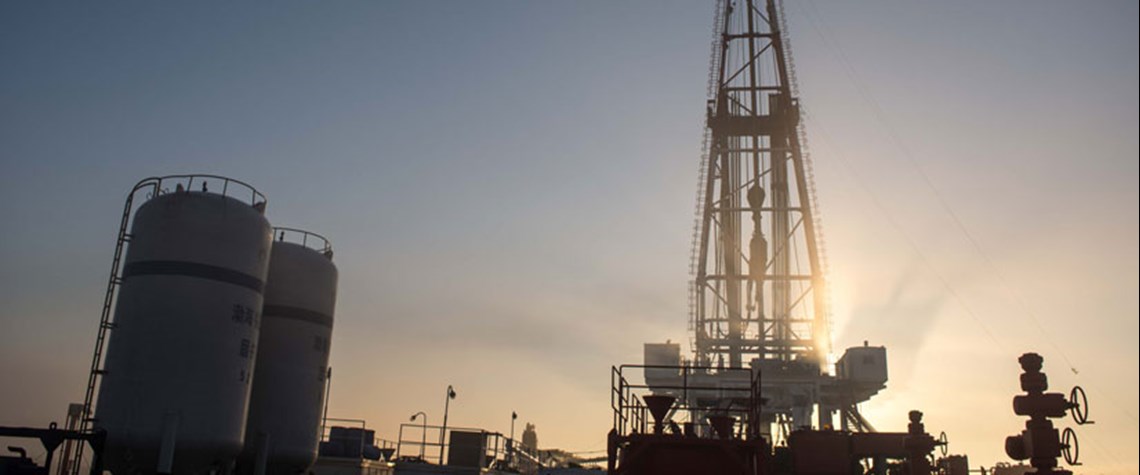

Iraq’s upstream shows signs of life

Baghdad is once again looking towards much higher long-term capacity goals

Iraq’s oil production hit a ten-month peak of 3.9mn bl/d in March, as the Opec+ cuts with which the country has, admittedly reluctantly, largely complied with began to ease. And federal export revenues were their highest for a year, ever since the brief Saudi-Russia oil price war was followed by Covid-19. With more production curbs set to lift and the prospect of further revenue growth, Iraq’s oil minister Ihsan Ismaael looked to the future in late March. The country’s new goal is to hike nationwide capacity—including that controlled by the Kurdistan Regional Government (KRG) in the semi-autonomous north—by some two-thirds, to 8m bl/d, by 2029. 8mn bl/d – Baghdad’s 2029 output goal W

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026