Global capex growth to moderate

Worldwide E&P spending is set to increase in 2023, albeit at a slower pace than last year, Evercore predicts

Building on robust growth in 2022, Evercore projects North American E&P spending will increase by 17.7pc in 2023 to within 7pc of pre-Covid levels. The US should lead again, with spending up 19.1pc in 2023, while Canada moderates at 10.5pc (see Fig. 1). Independents and private operators have an outsized role in North America, accounting for more than 70pc of regional capex. While privates were faster to increase capex post-Covid, the publicly traded independents shored up their balance sheets and prioritised returning cash to shareholders. We believe this trend could be reversing, with privates becoming more fiscally minded, as service cost inflation begins to rise. Privates make up abo

Also in this section

18 February 2026

With marketable supply unlikely to grow significantly and limited scope for pipeline imports, Brazil is expected to continue relying on LNG to cover supply shortfalls, Ieda Gomes, senior adviser of Brazilian thinktank FGV Energia,

tells Petroleum Economist

17 February 2026

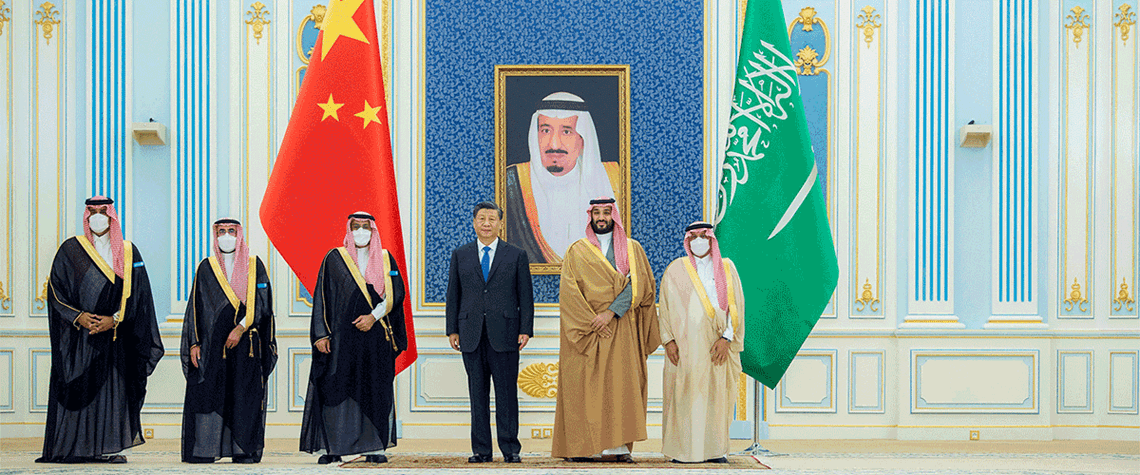

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond