When Spanish energy company Repsol announced in 2019 that it would be a net-zero greenhouse gas (GHG) emissions company by 2050, it was soon followed by a growing number of its peers. Today, most investor-owned oil and natural gas companies—including the supermajors—have set themselves similar targets, and national, state-owned hydrocarbons companies are starting to join them.

Most companies with crude oil and natural gas in their DNA now describe themselves as “multi-energy companies”, as clean energy technologies play an ever-greater role in their business portfolios.

However, it is one thing to decide where you want to end up at some time in the future and quite another to formulate a strategy and a roadmap for how to get there.

Which is why, in late 2020, Repsol followed up on its climate neutrality commitment with its 2021-25 Strategic Plan, along with intermediate emissions reduction goals for the decades to 2050. The company has ramped up its ambitions on several occasions, most recently at its latest ESG Day, held in London in October 2023.

“We were the first company in the world in our sector to commit to carbon neutrality by 2050, a pathway we are clearly delivering over the goals we defined in our Strategic Plan,” CEO Josu Jon Imaz told the gathered investors and analysts.

Technology uncertainties

“This is not an easy journey,” he continued. “As of today we can define with concreteness our determination, our targets to 2030. Longer term—when we look to 2040, 2050—there is still a significant element of uncertainty about which technologies will support our decarbonisation goals.”

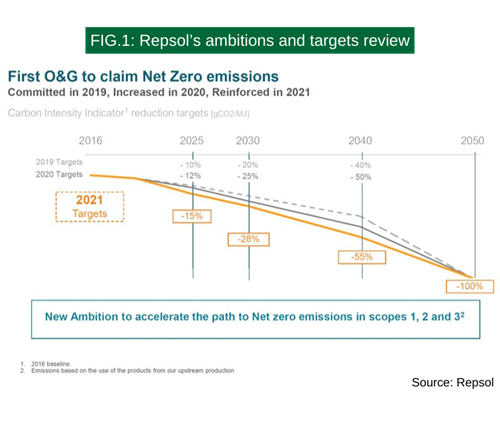

The chart below shows how Repsol’s carbon intensity reduction targets between now and 2050 have progressively ratcheted up since the company made its carbon neutrality pledge. A notable aspect is that they include scope three emissions—produced when upstream products are consumed—something some other energy companies have shied away from.

Repsol says that the increased ambition for its targets has been made possible by “a favourable regulatory environment and technological breakthroughs”.

Ratcheting up 2030 targets

Specific targets for 2030 have also ramped up, not least in the company’s low-carbon businesses, which include renewable electricity generation, renewable liquid fuels, circular economy products such as recycled polyolefins and green hydrogen.

Repsol’s target for renewable electricity generation capacity by 2030 is now 20GW, up from 15GW in the 2021-25 Strategic Plan, with a 2025 target of 6GW.

Achieving this objective will be helped by recent acquisitions, such as Asterion Energies in December 2022, which included a portfolio of 7,700MW of projects under development, mainly in Spain and Italy. In September 2023, the company entered the US onshore wind business by acquiring ConnectGen, a renewable energy company with development capabilities and a 20GW project portfolio.

In all, Repsol now has a wind and solar asset pipeline of almost 60GW. Moreover, with profitability paramount, it expects an equity internal rate of return on its low-carbon generation business of more than 10%.

Meanwhile, the company is progressing towards its target of producing 2mt/yr of renewable liquid fuels by 2030, with a 2025 target of 1.3mt.

At the turn of the year, production will start at the first plant in the Iberian Peninsula dedicated exclusively to advanced biofuels and sustainable aviation fuel, at the company’s industrial complex at Cartagena. It will have capacity to produce 250,000t/yr, saving 900,000t/yr of carbon dioxide emissions.

The €226m ($247m) project has been granted a €120m ($131m) loan by the European Investment Bank.

The second such plant, announced in July, will be built in Puertollano.

Balancing the trilemma

Repsol advocates a realistic approach to the continuing need for reliable supplies of oil and natural gas over coming decades as the energy transition gathers momentum. A transformation on the scale needed cannot happen overnight.

“In Europe, we have dangerously disregarded key aspects of the energy trilemma—formed by security of supply, affordable energy and sustainability,” said Imaz. “All three make up a triangle whose centre of gravity must be balanced. Decarbonisation is crucial, but let us never forget that energy cannot be solely about emissions. Above all, energy is security of supply.

“We must rethink the energy transition in Europe, which is based on ideological beliefs. We are rejecting investing in certain energy sources for ideological reasons, not technological or scientific ones.”

At the same time, Repsol believes that everything that can be done to decarbonise oil and gas activities should be done—and its strategy reflects that imperative.

Crucial to progress in building low-carbon businesses has been Repsol’s willingness to commit a large and growing proportion of its capital expenditure not just to new projects but also to research into and development of new technologies.

In its 2021-25 Strategic Plan, the company committed to capital expenditure over the five-year period of €18.3b ($20b), with €5.5b ($6b) of this—30%—allocated to low-carbon businesses. In 2023, this figure reached 42% of total capex.

Announcing the company’s financial results for the third quarter of 2023 in late October, Imaz said, “2023 is proving to be a year of profound transformation for Repsol, with steady progress in decarbonisation and the consolidation of our multi-energy profile.”

In line with its Strategic Plan, Repsol invested €4.36b ($4.77b) in the first nine months of 2023—an 82% year-on-year increase—mainly in low-carbon projects. The company estimates that 35% of its investments in 2023 will go to low-carbon initiatives.

Much of this is being spent on transforming the company’s major industrial centres, six of which are in the Iberian Peninsula, so that they manufacture products with low, neutral and even negative carbon footprints.

Repsol became the first company to make 100% renewable fuel available to customers on the Iberian Peninsula in 2023, after launching the supply of 100% renewable diesel at service stations and to fleets.

The company is promoting renewable fuels through alliances with leading companies in both heavy and passenger transportation—an effective solution for reducing emissions which, for sectors such as aviation and maritime transport, represents the fastest affordable route to their decarbonisation.

High grading the upstream

In its 2021-25 Strategic Plan, the company outlined its intention to focus its upstream oil and gas business on key geographical areas, prioritising value over volumes and the reduction of the emissions intensity of its asset portfolio.

The aim is to reduce carbon intensity from 43kg CO2/boe in 2016 to 11kg CO2/boe in 2025 with a 75% reduction of scope one and scope three, to put Repsol top of a 25-company peer group that includes the supermajors.

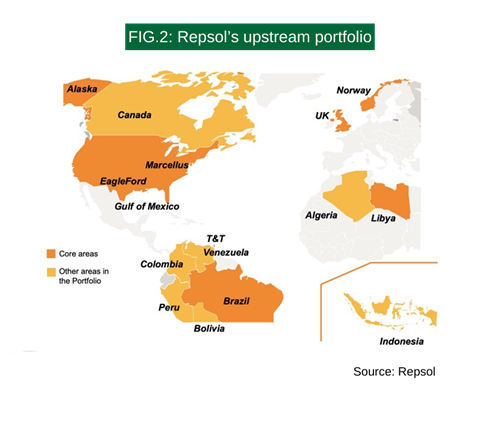

Fig.2 shows how the global footprint of the upstream business is changing, as the company works to reduce the number of countries it operates in from more than 25 to less than 14—exiting carbon-intensive and non-core assets.

The company is focusing new development in key areas such as the US and Brazil, as well as making “targeted acquisitions” in US shale and offshore plays. Since 2020, Repsol has made 14 discoveries that have added significant resources to its portfolio, mainly in the US and Mexico, development of which “will contribute to maintaining current levels of production until the end of the decade”.

Repsol recently approved development of the Campos 33 project in Brazil, which will produce significant volumes of natural gas—a fuel critical to ensuring a secure, affordable and sustainable energy transition.

The true value of Repsol’s upstream business became apparent in September 2022 when EIG—a US-based institutional investor—agreed to acquire a 25% working interest for $4.8b. This implied an enterprise value for the upstream business of $19b.

If there is one factor that is common to all of Repsol’s businesses, it is the need to adopt the best available technologies and, where possible, to develop new ones.

In the upstream business, the list of technologies that can be deployed to optimise exploration success and production efficiency is long and growing: artificial intelligence, big data, the internet of things, robotics, blockchain… Repsol is working on all of these and more.

There are interesting crossovers too between the upstream and the low-carbon businesses. For example, the expertise and technologies needed to develop oil and gas can equally be applied to developing carbon capture and storage and geothermal energy.

A measure of the credibility of Repsol’s strategy, also revealed at the company’s ESG Day, is that more than 37% of its institutional shareholder base is managed exclusively under ESG criteria—an almost fourfold increase in the number of ESG investors since 2016.

Renewable hydrogen

The company’s 2030 target for production of green—renewable—hydrogen has been raised to 1.9GWeq, 60% up on the previous target of 1.2GWeq.

In October, Repsol started up its first electrolyser for renewable hydrogen production at the company’s Petronor industrial centre at Biscay in Spain. The 2.5MW electrolyser can produce 350t/yr of green hydrogen for use in a refinery and to fuel buses and heavy goods vehicles. Much bigger electrolysers are planned.

Comments