Middle East refiners primed for growth

Capacity additions set to take advantage of disruption to Russian diesel

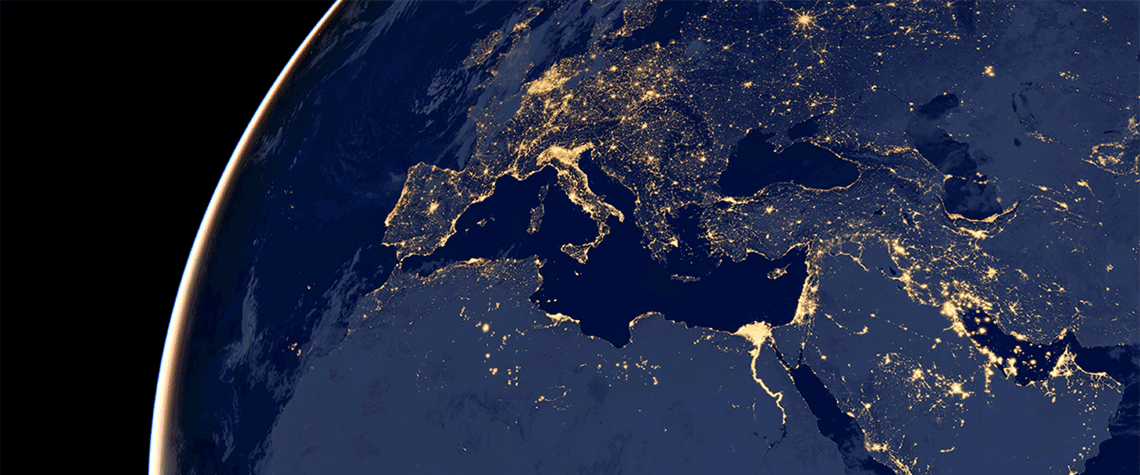

A combination of new refineries and the expansion of existing facilities means the Middle East is well positioned to capitalise on the potential drop-off in diesel and fuel supply from Russia and the expected rise in global oil demand. While the Middle East is often viewed as an upstream powerhouse—being home to six Opec nations—it is starting to also become known as a major downstream hub too—with more than 50 refineries. “New grassroots refineries and expansion projects across the Middle East in 2023 and 2024 are expected to push the region’s total refinery capacity (crude distillation and condensate splitter) from 9.7mn bl/d in 2022 to 10.5mn bl/d in 2023 and 11.1mn bl/d in 2024,” says Im

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised