Middle East refiners primed for growth

Capacity additions set to take advantage of disruption to Russian diesel

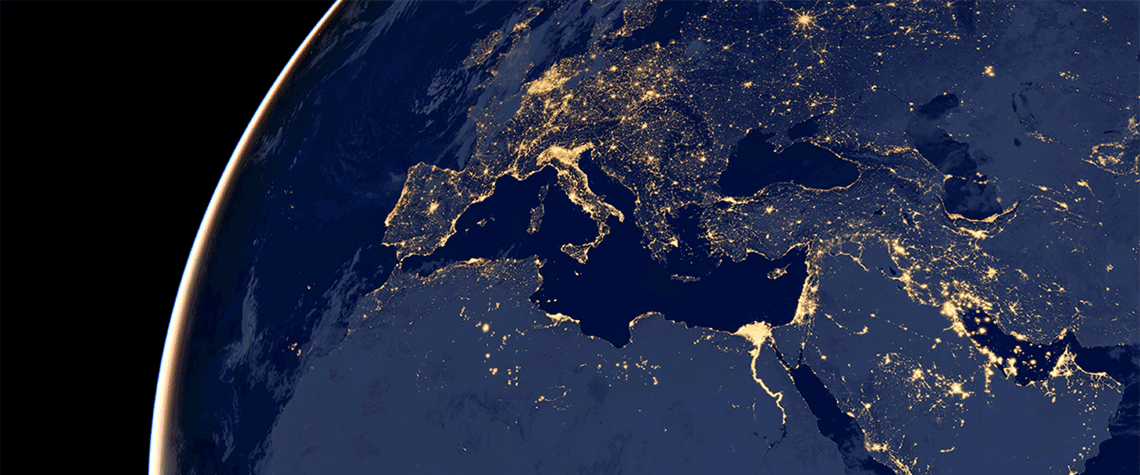

A combination of new refineries and the expansion of existing facilities means the Middle East is well positioned to capitalise on the potential drop-off in diesel and fuel supply from Russia and the expected rise in global oil demand. While the Middle East is often viewed as an upstream powerhouse—being home to six Opec nations—it is starting to also become known as a major downstream hub too—with more than 50 refineries. “New grassroots refineries and expansion projects across the Middle East in 2023 and 2024 are expected to push the region’s total refinery capacity (crude distillation and condensate splitter) from 9.7mn bl/d in 2022 to 10.5mn bl/d in 2023 and 11.1mn bl/d in 2024,” says Im

Also in this section

10 March 2026

Eni’s director for global gas and LNG portfolio, Cristian Signoretto, discusses how demand will respond to rising LNG supply, and how the company is expanding its own gas and LNG operations through disciplined, capital-efficient investments

9 March 2026

Petroleum Economist analysis sees increases in output from Saudi Arabia, Venezuela and Kazakhstan among others before region’s murky descent

9 March 2026

Energy sanctions are becoming an increasingly prominent tool of US foreign policy, with the country’s growth in oil and gas production allowing it to impose pressure on rivals without jeopardising its own energy security or that of its allies, argues Matthew McManus, a visiting fellow at the National Center for Energy Analytics

6 March 2026

The March 2026 issue of Petroleum Economist is out now!