Middle East refiners primed for growth

Capacity additions set to take advantage of disruption to Russian diesel

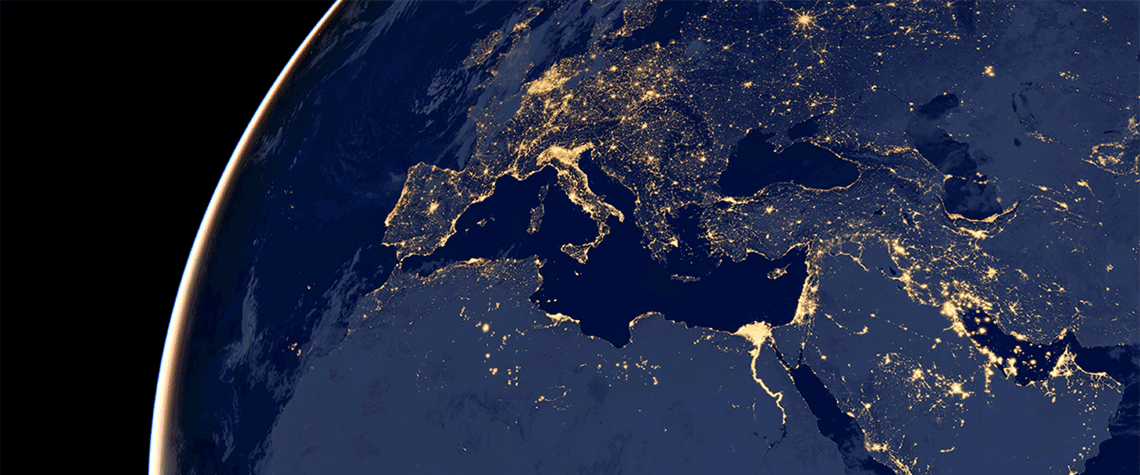

A combination of new refineries and the expansion of existing facilities means the Middle East is well positioned to capitalise on the potential drop-off in diesel and fuel supply from Russia and the expected rise in global oil demand. While the Middle East is often viewed as an upstream powerhouse—being home to six Opec nations—it is starting to also become known as a major downstream hub too—with more than 50 refineries. “New grassroots refineries and expansion projects across the Middle East in 2023 and 2024 are expected to push the region’s total refinery capacity (crude distillation and condensate splitter) from 9.7mn bl/d in 2022 to 10.5mn bl/d in 2023 and 11.1mn bl/d in 2024,” says Im

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026