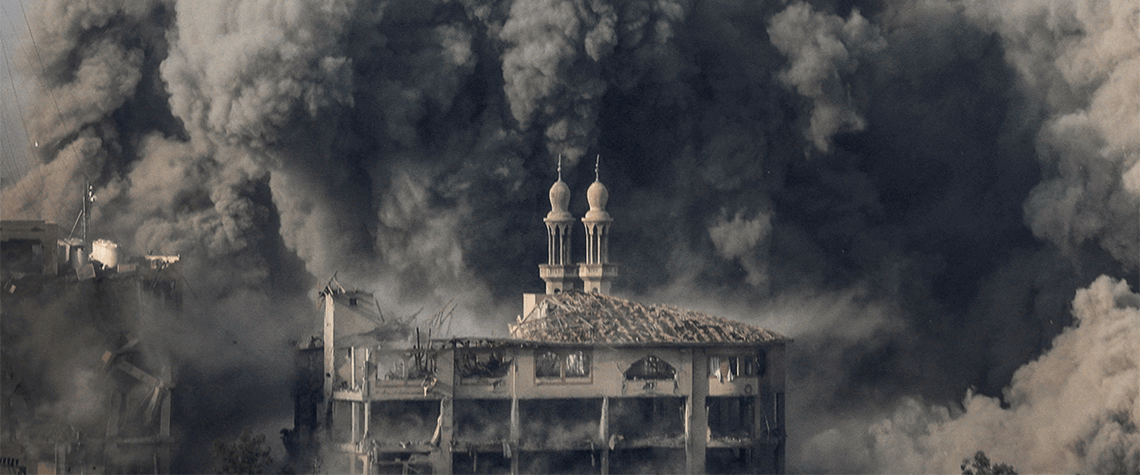

Israel-Hamas war clouds energy prospects

The threat of a big disruption to energy trade in the Middle East appears to be receding, but the fog of war is casting doubt on projects in the region

The war in Gaza may still escalate beyond the borders of Israel and the Palestinian territories and cause major energy disruptions, but the likelihood of this appeared to have receded by early December as a ceasefire came and went and hostilities remained largely constrained to the Gaza Strip and surrounding areas. Instead, experts say, different tracks of negotiations are picking up, with the entire Middle East in flux and Qatar’s status in particular elevated—as both an energy powerhouse and a geopolitical deal maker. Global oil and gas prices spiked immediately after the surprise attack by Hamas on 7 October, which claimed more than 1,200 Israeli lives and disrupted regional energy trade.

Also in this section

18 February 2026

With Texas LNG approaching financial close, Alaska LNG advancing towards a phased buildout and Magnolia LNG positioned for future optionality, Glenfarne CEO Brendan Duval says the coming year will demonstrate how the company’s more focused, owner-operator approach is reshaping LNG infrastructure development in the North America

18 February 2026

The global gas industry is no longer on the backfoot, hesitantly justifying the value of its product, but has greater confidence in gas remaining a core part of the global energy mix for decades

18 February 2026

With marketable supply unlikely to grow significantly and limited scope for pipeline imports, Brazil is expected to continue relying on LNG to cover supply shortfalls, Ieda Gomes, senior adviser of Brazilian thinktank FGV Energia,

tells Petroleum Economist

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”