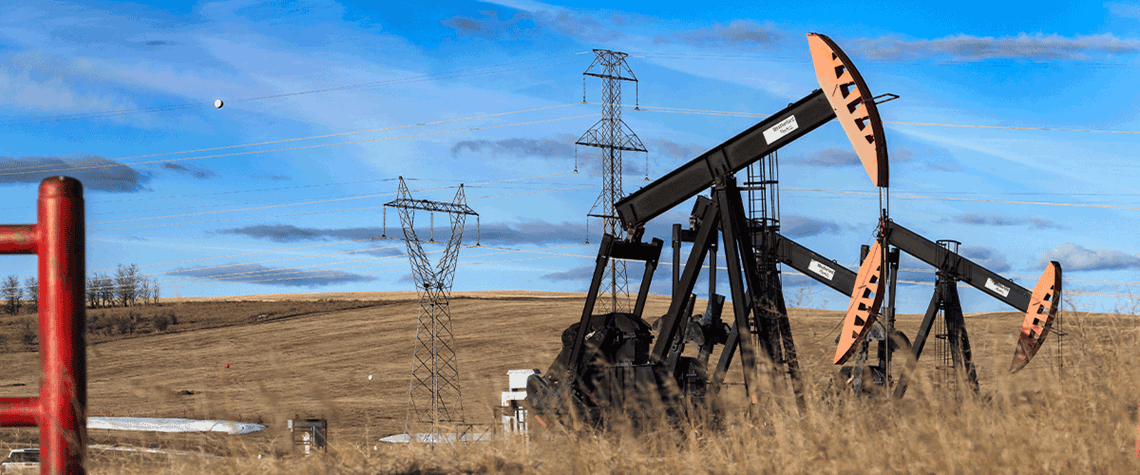

Letter from Canada: Greater volatility ahead for WCS discount

International events, rather than infrastructure bottlenecks, have undermined prices for Western Canadian crude

The price discount for Western Canadian Select (WCS) heavy crude against WTI has blown out in recent months. But the cause has been global events rather than a lack of pipeline and rail takeaway capacity, as was the case during previous price declines in the past decade. For instance, the 3.3mn bl/d Enbridge Mainline pipeline has seen either low or no use since the Line 3 replacement project was completed in October 2021, adding around 370,000bl/d in capacity. And just over a tenth of western Canada’s crude-by-rail export capacity of 1.33mn bl/d has been used in recent months. Instead, fallout from Russia’s invasion of Ukraine has caused a general widening of crude quality differentials the

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026