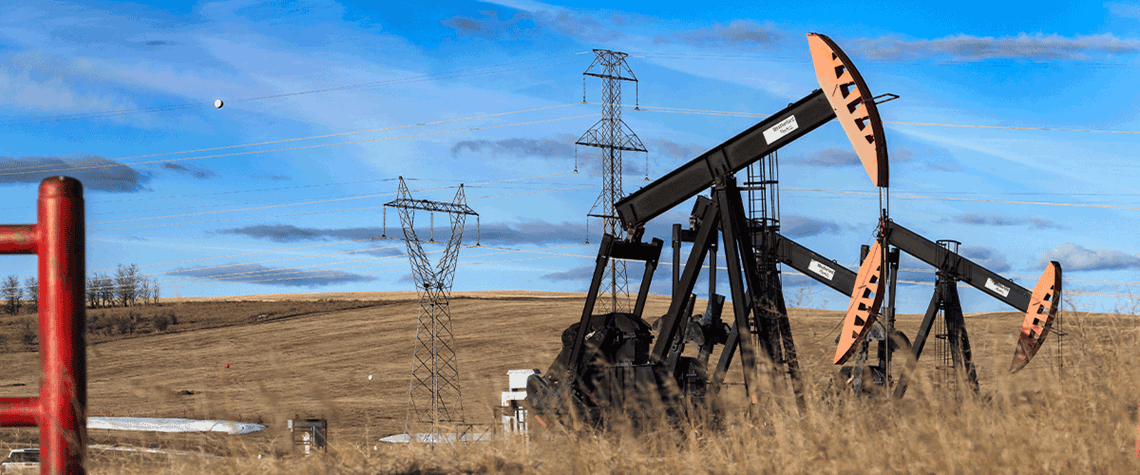

Letter from Canada: Greater volatility ahead for WCS discount

International events, rather than infrastructure bottlenecks, have undermined prices for Western Canadian crude

The price discount for Western Canadian Select (WCS) heavy crude against WTI has blown out in recent months. But the cause has been global events rather than a lack of pipeline and rail takeaway capacity, as was the case during previous price declines in the past decade. For instance, the 3.3mn bl/d Enbridge Mainline pipeline has seen either low or no use since the Line 3 replacement project was completed in October 2021, adding around 370,000bl/d in capacity. And just over a tenth of western Canada’s crude-by-rail export capacity of 1.33mn bl/d has been used in recent months. Instead, fallout from Russia’s invasion of Ukraine has caused a general widening of crude quality differentials the

Also in this section

10 March 2026

By shutting the Strait of Hormuz, Iran has cut exports of distillate-rich Middle Eastern crude, jet fuel and diesel, and is holding the energy market hostage

10 March 2026

Eni’s director for global gas and LNG portfolio, Cristian Signoretto, discusses how demand will respond to rising LNG supply, and how the company is expanding its own gas and LNG operations through disciplined, capital-efficient investments

9 March 2026

Petroleum Economist analysis sees increases in output from Saudi Arabia, Venezuela and Kazakhstan among others before region’s murky descent

9 March 2026

Energy sanctions are becoming an increasingly prominent tool of US foreign policy, with the country’s growth in oil and gas production allowing it to impose pressure on rivals without jeopardising its own energy security or that of its allies, argues Matthew McManus, a visiting fellow at the National Center for Energy Analytics