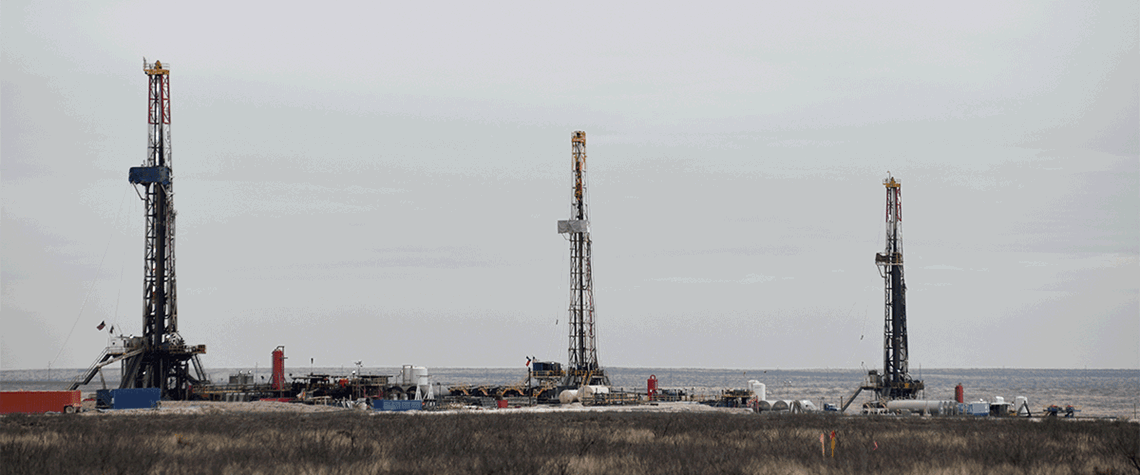

Shale drillers try to stay patient amid gas price slump

Producers resist urge to respond too quickly to gas price trends

US shale drillers are keeping their plans unchanged for now as they ride the peaks and troughs of gas price volatility. Prices spiked last year in the wake of Russia’s invasion of Ukraine but have since dropped back to pre-war levels, and analysts question whether the industry has learned lessons from the past—when quick responses to price changes have left producers playing catch-up. Certainly, the industry remains sensitive to price signals, and further fluctuations will shape how gas drilling plays out over the remainder of 2023 and beyond. Various other factors will also have an impact on behaviour, however, including how companies are structured and what their asset mixes look like. Whi

Also in this section

18 February 2026

With marketable supply unlikely to grow significantly and limited scope for pipeline imports, Brazil is expected to continue relying on LNG to cover supply shortfalls, Ieda Gomes, senior adviser of Brazilian thinktank FGV Energia,

tells Petroleum Economist

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond