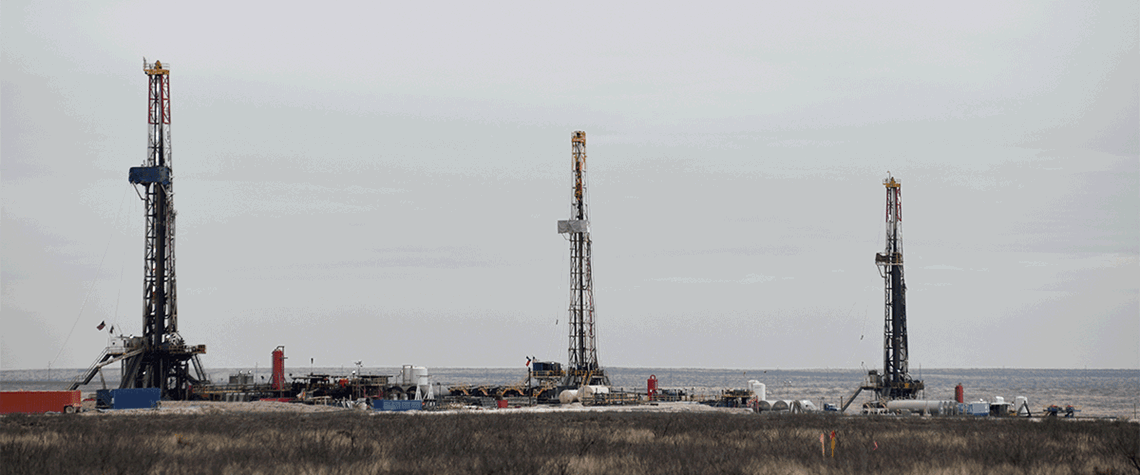

Shale drillers try to stay patient amid gas price slump

Producers resist urge to respond too quickly to gas price trends

US shale drillers are keeping their plans unchanged for now as they ride the peaks and troughs of gas price volatility. Prices spiked last year in the wake of Russia’s invasion of Ukraine but have since dropped back to pre-war levels, and analysts question whether the industry has learned lessons from the past—when quick responses to price changes have left producers playing catch-up. Certainly, the industry remains sensitive to price signals, and further fluctuations will shape how gas drilling plays out over the remainder of 2023 and beyond. Various other factors will also have an impact on behaviour, however, including how companies are structured and what their asset mixes look like. Whi

Also in this section

10 March 2026

By shutting the Strait of Hormuz, Iran has cut exports of distillate-rich Middle Eastern crude, jet fuel and diesel, and is holding the energy market hostage

10 March 2026

Eni’s director for global gas and LNG portfolio, Cristian Signoretto, discusses how demand will respond to rising LNG supply, and how the company is expanding its own gas and LNG operations through disciplined, capital-efficient investments

9 March 2026

Petroleum Economist analysis sees increases in output from Saudi Arabia, Venezuela and Kazakhstan among others before region’s murky descent

9 March 2026

Energy sanctions are becoming an increasingly prominent tool of US foreign policy, with the country’s growth in oil and gas production allowing it to impose pressure on rivals without jeopardising its own energy security or that of its allies, argues Matthew McManus, a visiting fellow at the National Center for Energy Analytics