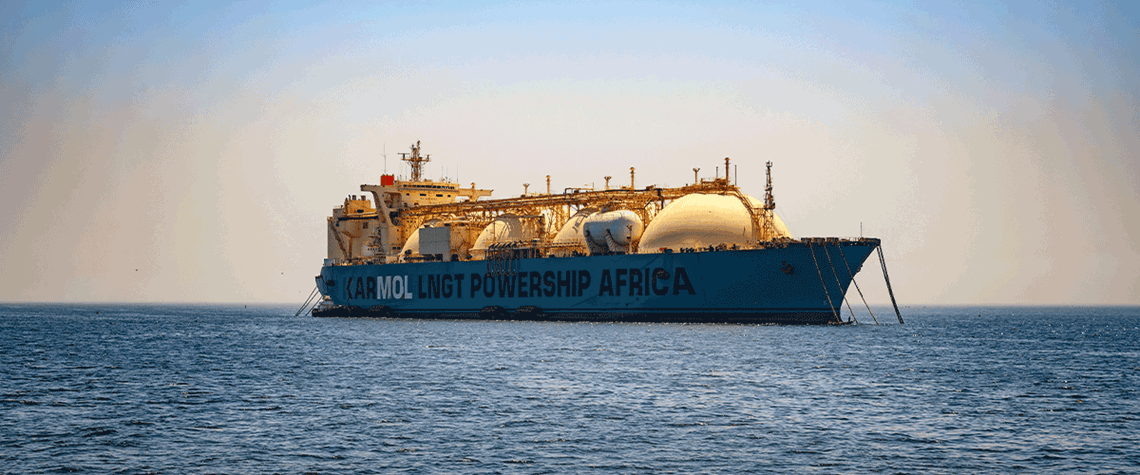

Outlook 2024: LNG investment - Hydrocarbon challenges or green opportunity?

Many LNG projects already incorporate emissions mitigation methods, hastening adoption for future projects

This decade’s unprecedented LNG supply investment is strongly focused on managing emissions intensity. Wide-ranging measures, particularly CCS, renewable-energy-powered liquefaction trains, carbon offsets and FLNG conversions, are being aggressively rolled out globally. While previous cycles of LNG production growth focused on the environmental benefits of offsetting buyers’ coal demand and shippers’ liquid fuel usage, supply projects are now under the greenhouse gas (GHG) microscope. Geopolitics and supply under-investment combined to push LNG spot prices to record highs in 2022 and c.$20/m Btu this winter. While LNG cargos will remain scarce until 2026, new trains, mainly in the US and Qat

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised