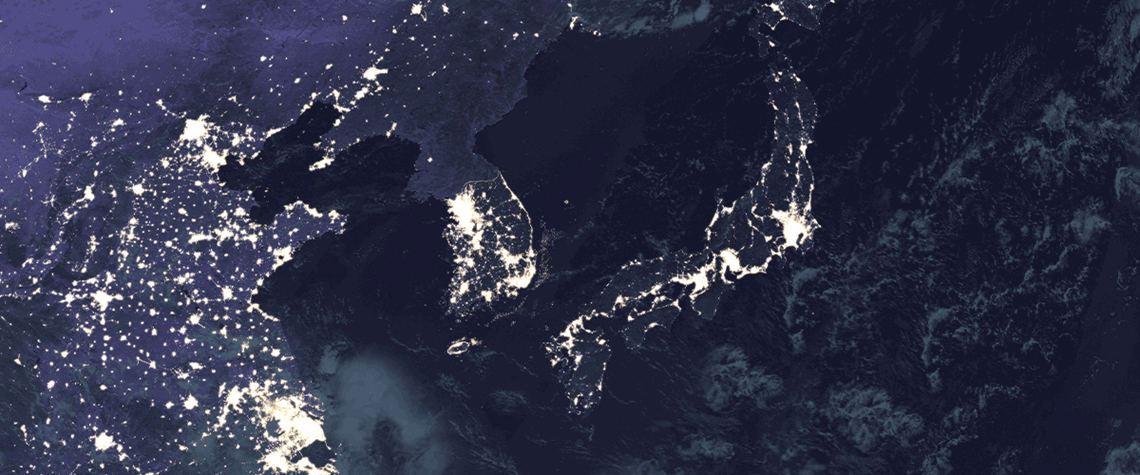

Muted winter LNG outlook for NE Asia

Seasonal temperatures will prove critical, but the LNG demand prospects for China, Japan and South Korea are currently soft

China is set to lead gas demand growth in Northeast Asia this winter amid signs the region’s biggest economy is bottoming out, although this is unlikely to mean a big jump in LNG imports as the country taps other sources of supply. And at the same time, more nuclear availability is expected to weigh on seasonal demand in Japan and South Korea. Recent green shoots in China’s economy suggest growth is stabilising, which may help domestic gas demand maintain momentum. China’s GDP beat predictions in Q3, with year-on-year growth of 4.9%, lifting growth for the first nine months of 2023 to 5.2%—ahead of Beijing’s official target of c.5%. Chinese gas demand has been strengthening since the spring,

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised