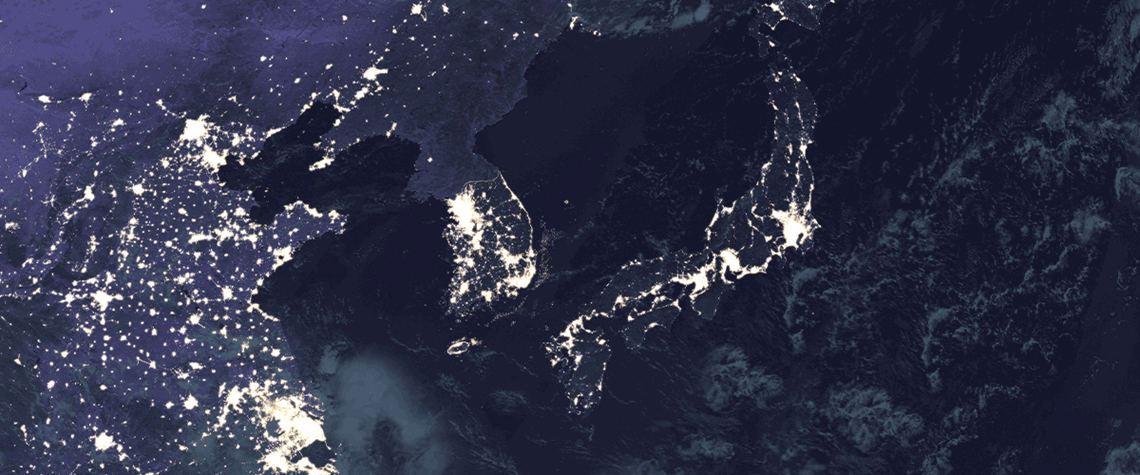

Muted winter LNG outlook for NE Asia

Seasonal temperatures will prove critical, but the LNG demand prospects for China, Japan and South Korea are currently soft

China is set to lead gas demand growth in Northeast Asia this winter amid signs the region’s biggest economy is bottoming out, although this is unlikely to mean a big jump in LNG imports as the country taps other sources of supply. And at the same time, more nuclear availability is expected to weigh on seasonal demand in Japan and South Korea. Recent green shoots in China’s economy suggest growth is stabilising, which may help domestic gas demand maintain momentum. China’s GDP beat predictions in Q3, with year-on-year growth of 4.9%, lifting growth for the first nine months of 2023 to 5.2%—ahead of Beijing’s official target of c.5%. Chinese gas demand has been strengthening since the spring,

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026