Global LNG analysis report 2023 – Part 4

The fourth and final part of this deep-dive analysis looks at LNG projects planned or underway across the Americas

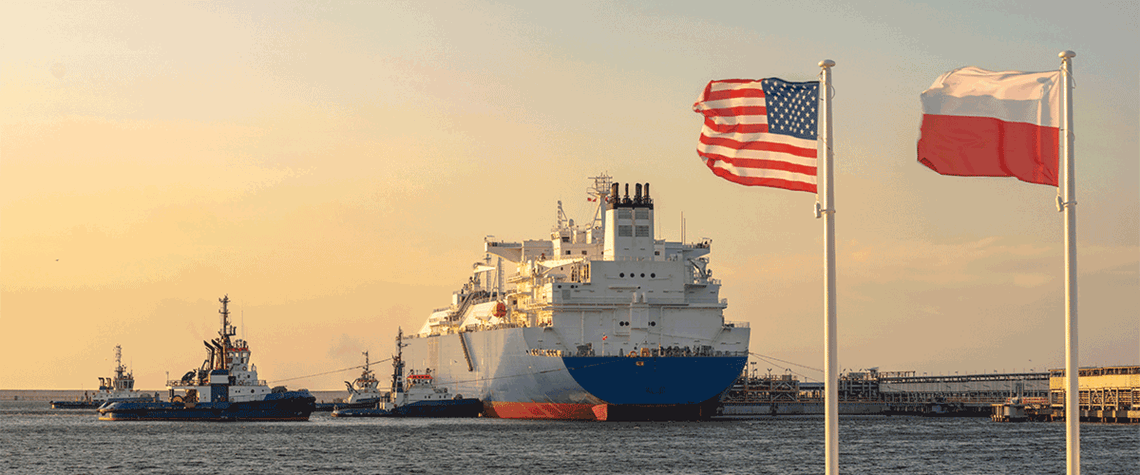

Global gas demand is being by short-term and long-term factors including the energy transition and the war in Ukraine. The first three parts of this report covered liquefaction and regasification projects in Africa, the Middle East, Asia and Europe. This fourth instalment examines North and Central/South Americas. Most notably within the region, the US has transformed itself from being an importer of gas around a decade ago to being the largest supplier of LNG in the world. North of the border, Canada has had less success in progressing its projects, with only a small number likely to push ahead to completion. Meanwhile, in Central and South America, Mexico remains the most significant count

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026