A convergence of economic, geopolitical, trade and policy factors have exacerbated the issue of years of underinvestment in upstream hydrocarbon production and has triggered a change in energy markets. The hard push to transition to renewables and clean energy alternatives created an unprecedented reduction of investment in hydrocarbon-based energy, in favour of developing green resources. In 2021, global oil and gas discoveries hit their lowest level in 75 years. Total global discovered volumes were calculated at 4.7b boe, the lowest tally since 1946.

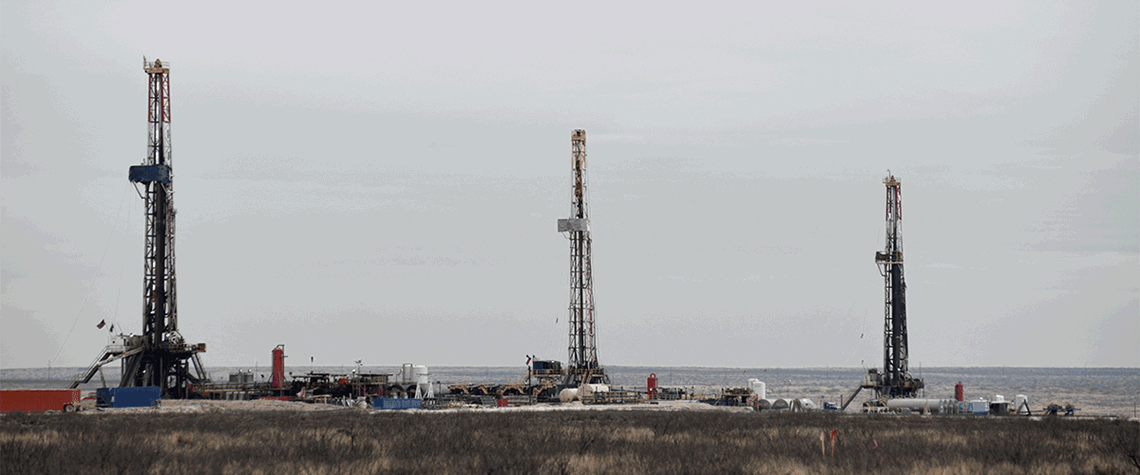

Despite the record-low resource replenishment, US shale players followed investor mandates for measured investment and financial discipline (see Fig.1), but this approach reduced capex and contributed to a tight market, which caused WTI to hit a 14-year high of $115/bl in June 2022.

The continued shift away from traditional energy investment has altered the three major components of a balanced energy equation: energy security; supply diversification; and lower-carbon production/technologies. Additionally, the uncertainty surrounding energy policy and carbon costs has increased pressure on all three components, causing concerns and ongoing issues.

ESG impact fading

The drive to abandon drilling for hydrocarbons lessened during H1 2023 as climate concerns and the ESG initiative lost momentum. Many US oil companies are getting back to the business of drilling and completing oil and gas assets. Investments by several major players are surging as companies shake off the notion that an energy transition can be achieved by quickly switching to green alternatives.

At the World Petroleum Congress, held in Calgary during the week of 18 September, Saudi Aramco CEO Amin Nasser said that “the IEA’s prediction that oil consumption will peak this decade and grow at a slower rate in the near term, as the energy transition gathers pace, has been proven to be unrealistic”, (see Fig.2, overleaf). “This notion is also wilting under scrutiny, because it is mostly being driven by policies rather than the proven combination of markets, competitive economics and technology. There is no quick fix for the energy transition,” Nasser concluded.

Another indication that the majors are moving back into fossil fuels is the consensus that lowering carbon emissions will require much more gas than previously stated. The US is forging ahead with new projects that will make it one of the world’s top LNG exporters. This momentum marks a turning point for gas, which the environmentalists thought would serve as a short-term bridge while developing “cleaner” alternatives and would be phased out in the near-future. But with the promise of renewables failing to materialise, the idea that gas demand will peak anytime soon has vanished.

“LNG sellers look around this market and feel pretty confident that gas demand will be with us for decades to come,” said Ben Cahill, senior fellow with the Center for Strategic and International Studies. Russia’s invasion of Ukraine, and the subsequent energy crisis and record-breaking price surge, has changed the long-term prospects for gas, he said.

OPEC cuts supply

Major consuming nations have criticised the Saudis and their allies for constricting supplies during a period of record demand, warning that a renewed inflationary spike would squeeze consumers and endanger the global recovery. Nonetheless, Riyadh said it could deepen current cutbacks if deemed necessary. OPEC output plunged in September to a two-year low, as the Saudis implemented a unilateral reduction of 1m b/d, while Russia also cut exports. As a result, global crude markets are forecast to have a supply shortfall of 1.2m b/d by year-end, as the cuts are causing serious concern about commodity availability.

The impact of the above factors is higher energy prices and improved cash flows for producers. The balance that companies strike between increasing investment and continuing capital discipline is a major factor. However, the US industry’s investment trajectory for the remainder of 2023 will likely be more focused on traditional hydrocarbons-based development, as renewables have proven to be a poor investment. Producers that had ventured into the lower-margin renewable power business are now rethinking those investments, due to lacklustre returns.

Macro US picture

The Baker Hughes rotary rig count stood at 772 during the week ending 6 January 2023. US drilling activity remained steady, averaging 758 rigs during the first four months of the year. The count started dropping during late April despite a relatively stable WTI price of approximately $72/bl. The rig count then steadily declined for the next four months, dropping to 631 during the week ending 1 September. The September tally is the lowest since 4 February 2022, when the count stood at 613.

The 141-rig loss represents a 22% decrease in activity and occurred mainly in gas-dominated shale fields as operators stacked rigs in these regions, due to depressed gas prices. Those low prices occurred despite prolonged record heat in a large portion of North America over the last several months. The market showed no signs of recovery, with gas at the Henry Hub trading at $2.58/m Btu in August, compared with $2.55/m Btu in July. Despite short-term price stability, the 12-month running average at the Henry Hub plummeted by 12% in August, down to $3.68/m Btu. This documents the protracted price decline since August 2022, when operators were receiving $8.81/m Btu.

Drilled-but-uncompleted

Despite depressed US gas prices, operators continue to drill in gas-dominated regions, but with less intensity. The number of drilled-but-uncompleted (DUC) wells in the major oil plays continues to drop, but not as rapidly as in previous months (see Fig.1). There were 4,749 DUCs in the US in August 2023, 406 more than the 4,343 tallied in August 2022. The build in the DUC inventory has moderated in recent months, but only two of the seven regions mapped by the EIA show year-on-year declines. In the Niobrara, DUCs are up to 769 (an increase of 112%); while the Haynesville region has 789 (up by 54%); Appalachia, 714 (up 27%); and the Bakken, 474 DUCs (the same as a year ago). On a positive note, the Permian and Eagle Ford saw year-on-year declines of 26% and 25% in their DUC inventories, respectively.

Overall US forecast

In the third-quarter of 2023, OPEC+ reduced oil supply during a period of record demand sparked by an increase in Chinese consumption and an uptick in petrochemical feedstock requirements. The combination of factors caused a supply shortfall of 1.2m b/d, as Saudi Arabia extended its production cuts, causing concern about commodity availability. Additionally, a substantial drawdown in inventory caused benchmark crude prices to surge to a ten-month high for the week of 15 September, with Brent up to $93.87/bl and WTI jumping to $89.14/bl.

Despite the combination of restricted Saudi supply, increased demand and surging oil prices, World Oil forecasts a slight downturn in drilling activity for the remainder of the year, projecting 18,210 total wells for 2023—a 1.7% decrease from the 2022 count of 18,529 (see Fig.2).

However, total footage is projected to increase from 252.9m ft in 2022 to 258.3m ft in 2023—a jump of 2.1%. A total of 9,204 wells are estimated to have been drilled during H1 2023, while 9,006 are predicted to spud in the second half of the year, a drop of 2.2%. A 3.9% reduction in footage is expected in H2.

Although World Oil has confidence in this forecast, if crude prices persist at $90/bl or higher, activity may increase more than expected. However, if the price drops sufficiently below $90/bl, then we may see a greater decline in H2. We are predicting a mild increase in the fourth quarter, which is why some numbers are not forecast lower.

An extended version of this article was originally published in our sister title, World Oil available here.

Comments