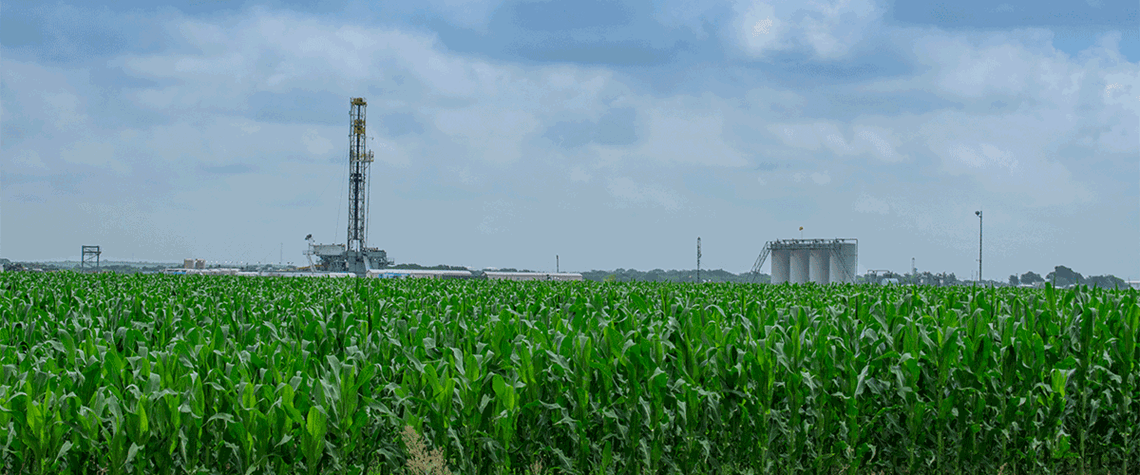

Consolidation heats up for maturing US shale

Growth might not be on the table, but operators are eyeing opportunities to add quality acreage

Lack of midstream capacity and dismal upstream growth prospects for 2023 are proving no barrier to M&A activity for maturing US shale basins. Over the past quarter, both the Eagle Ford and Appalachia recorded bumper deals that showcase the perceived long-term potential among operators. In the Eagle Ford, US independent Devon Energy snapped up Texas-focused Validus Energy for $1.8bn last year. The deal doubled the firm’s production base in the basin and increased exposure and access to Gulf Coast pricing. In July, the operator also added a bolt-on acquisition in the Williston basin but stressed there was not likely to be further spending in the immediate future. Other operators soon fo

Also in this section

26 July 2024

Oil majors play it safe amid unfavourable terms in latest oil and gas licensing bid rounds allowing Chinese low-ball moves

25 July 2024

Despite huge efforts by India’s government to accelerate crude production, India’s dependency shows no sign of easing

24 July 2024

Diesel and jet fuel supplies face a timebomb in just four years, and even gasoline may not be immune

23 July 2024

Rosneft’s Arctic megaproject is happening despite sanctions, a lack of foreign investment and OPEC+ restrictions. But it will take a long time for its colossal potential to be realised