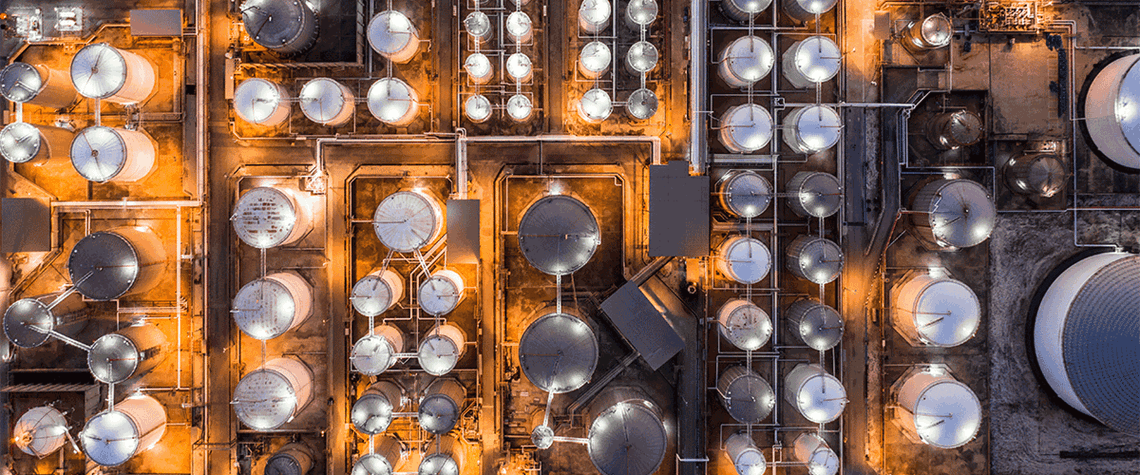

Russia finds the ships to access new product markets

Refining runs and questions over blending—not vessel availability—are likely to determine Russian product export volumes

The EU’s ban on imports of Russian products came into force on 5 February, prompting the latest phase in the global reshuffling of hydrocarbon trade since the invasion of Ukraine. Some in the market have questioned whether there would be enough tankers willing and able to transport Russian products, but so far access to ships does not seem to be a constraint on the pariah state’s exports. The shift since the start of the product import ban has been “stark”, says shipbrokers EA Gibson, with Russia “relatively successful" in finding new markets for more than 1mn bl/d of clean products. And this Russian trade is profitable for shipowners, says Ioannis Papadimitriou, senior freight analyst at an

Also in this section

12 December 2025

The latest edition of our annual Outlook publication, titled 'The shape of energy to come: Creating unique pathways and managing shifting alliances', is available now

12 December 2025

The federal government is working with Alberta to improve the country’s access to Asian markets and reduce dependence on the US, but there are challenges to their plans

11 December 2025

The removal of the ban on oil and gas exploration and an overhaul of the system sends all the right messages for energy security, affordability and sustainability

10 December 2025

The economic and environmental cost of the seven-year exploration ban will be felt long after its removal