Letter from the US: OPEC+ faces US merger threat

The ‘megaproducers’ on the rise following ExxonMobil deal will be less susceptible to OPEC pressure

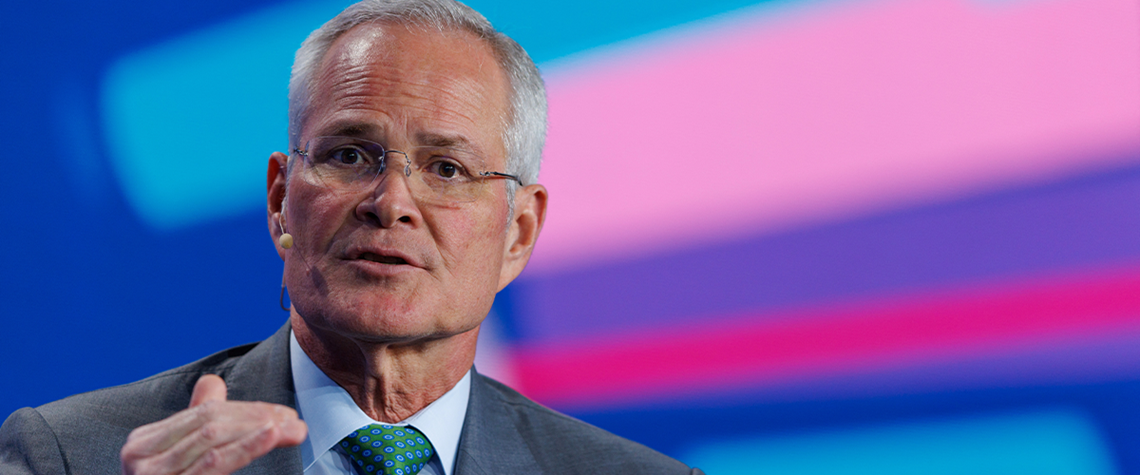

ExxonMobil’s move to acquire independent Pioneer Natural Resources creates a direct threat to OPEC+ members, particularly Saudi Arabia and Russia. The merged company’s crude production will be larger than all but five or six OPEC+ countries. Further acquisitions made by Chevron and other US producers will create additional large competitors, and these new ‘megaproducers’ will be far less susceptible to calls from oil-exporting nations to reduce output when global supply surpluses pressure prices. In recent years, three current or past CEOs of independent oil producers—Ryan Lance of ConocoPhillips, Vicki Hollub of Occidental Petroleum, and Scott Sheffield of Pioneer—have exhorted other US pro

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026