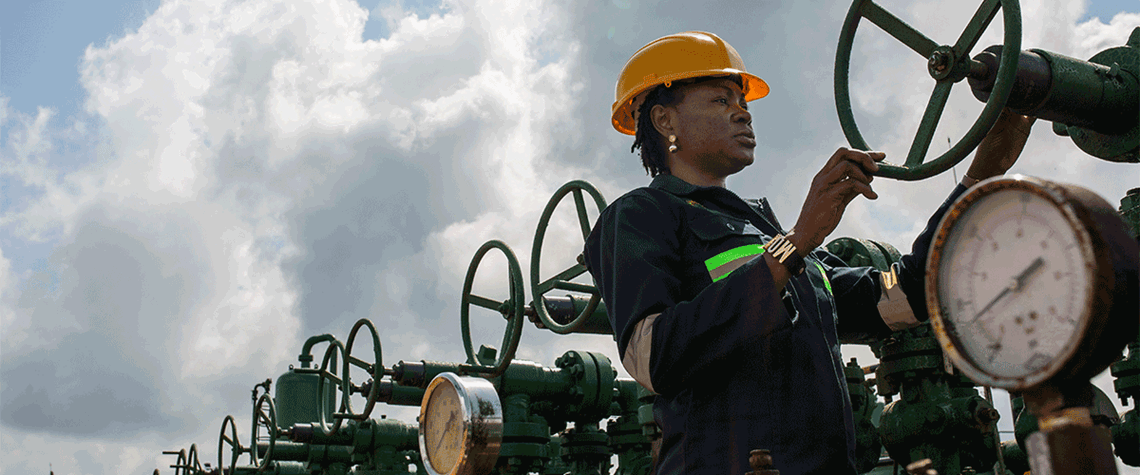

Letter on Africa: Nigeria's oil and gas industry needs more than new faces

IOCs are reducing their footprint in what was until recently Africa's largest oil producer despite key oil legislation being passed

Nigeria’s oil and gas industry needs a reset. Years of underinvestment, crude theft and sabotage have weighed down output. Oil production hit a low of 1.1mn bl/d in mid-2022, almost half that seen in January 2020. Although output in December 2022 was up to 1.4mn bl/d of crude and condensate, the medium-to-long-term outlook is not encouraging, and the 2mn bl/d it reached just a few years ago seems a distant memory. With presidential elections imminent, can a change of guard breathe much-needed life into the country’s ailing industry? The current administration was able to oversee the passage of the long-awaited Petroleum Industry Act (PIA), but subsequent implementation has been slow. And cru

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026