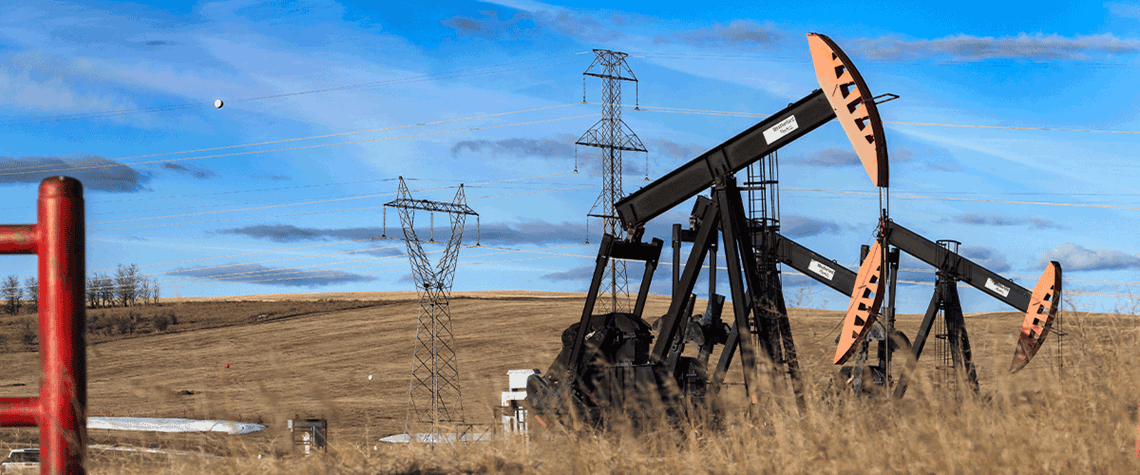

Letter from Canada: Greater volatility ahead for WCS discount

International events, rather than infrastructure bottlenecks, have undermined prices for Western Canadian crude

The price discount for Western Canadian Select (WCS) heavy crude against WTI has blown out in recent months. But the cause has been global events rather than a lack of pipeline and rail takeaway capacity, as was the case during previous price declines in the past decade. For instance, the 3.3mn bl/d Enbridge Mainline pipeline has seen either low or no use since the Line 3 replacement project was completed in October 2021, adding around 370,000bl/d in capacity. And just over a tenth of western Canada’s crude-by-rail export capacity of 1.33mn bl/d has been used in recent months. Instead, fallout from Russia’s invasion of Ukraine has caused a general widening of crude quality differentials the

Also in this section

24 October 2024

Producers in the region see significant gains to be made by boosting output using the infrastructure already in place

23 October 2024

Markets have seen no material disruption from the war so far, but as the fighting goes on it is a matter of when, not if

23 October 2024

Majors in the region are pushing boundaries and could see significant upside, but longer-term risks remain

22 October 2024

Angola is unlikely to meet the official timeline for an IPO of state-owned oil giant Sonangol in 2026