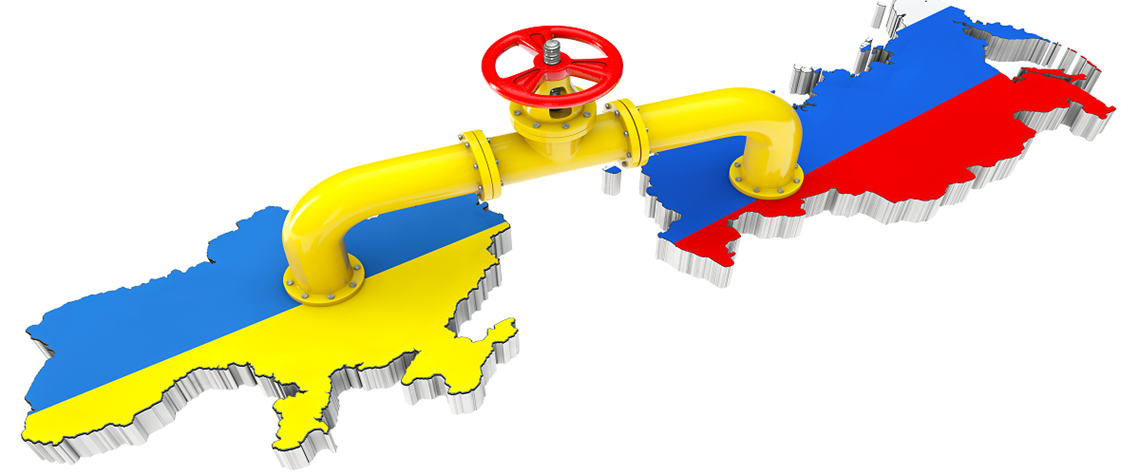

Gazprom finds it hard to break with Ukraine

An international court ruling over gas supply contracts has done little to resolve differences between Gazprom and Naftogaz

Gazprom is desperate to eliminate the need to use Ukraine's transport network to send gas supply to Europe, but a lack of alternatives means it will probably have to swallow its pride and sign a new deal beyond 2020. Russia's gas export monopoly halted a planned resumption of gas supply to the Ukrainian domestic market in early March, forcing Kiev to take emergency measures to make up for the shortfall and warn that transit flows to Europe were also at risk. Gazprom had planned to restart supplies to its neighbour's domestic market for the first time since 2015, when Ukraine started buying gas from Europe to reduce its energy dependence on Russia. The move came after a Stockholm arbitration

Also in this section

18 February 2026

The global gas industry is no longer on the backfoot, hesitantly justifying the value of its product, but has greater confidence in gas remaining a core part of the global energy mix for decades

18 February 2026

With marketable supply unlikely to grow significantly and limited scope for pipeline imports, Brazil is expected to continue relying on LNG to cover supply shortfalls, Ieda Gomes, senior adviser of Brazilian thinktank FGV Energia,

tells Petroleum Economist

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce