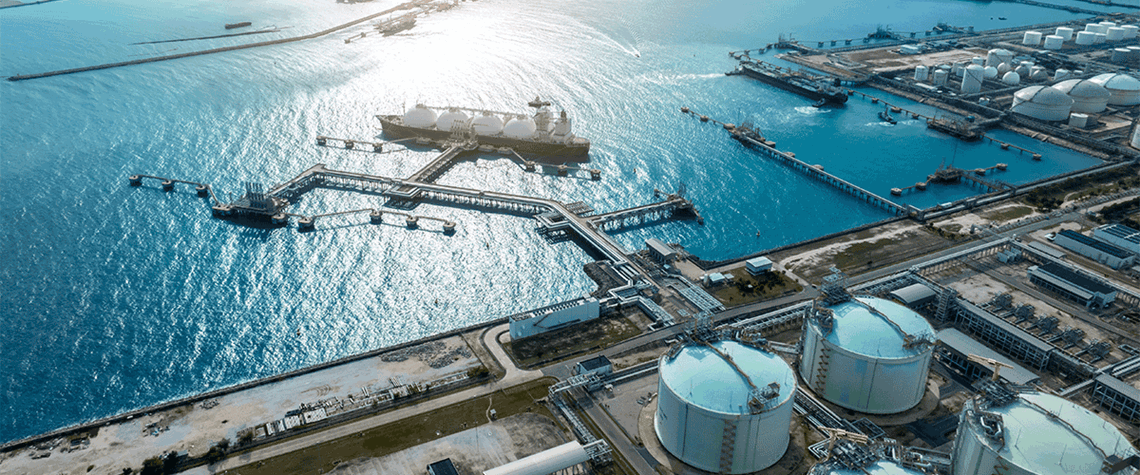

Outlook 2024: Building LNG’s resilience through turbulent times

Larger and more diversified portfolios are best placed to navigate through volatility

The global LNG industry is thriving. A record 200mt/yr of new supply is under construction as players bet big on Asia’s push to reduce its dependence on coal and Europe’s need to replace Russian gas. Given the urgency of the energy transition, an increasingly fractious geopolitical system and concerns over global economic growth, could the LNG industry have bitten off more than it can chew? In this article, we explore some of the market and external risks that players need to grapple with and consider how they can prosper through turbulent times. Is there too much LNG under construction? In short, no. Increased supply availability will bring prices down and boost demand growth. In our latest

Also in this section

20 February 2026

The country is pushing to increase production and expand key projects despite challenges including OPEC+ discipline and the limitations of its export infrastructure

20 February 2026

Europe has transformed into a global LNG demand powerhouse over the last few years, with the fuel continuing to play a key role in safeguarding the continent’s energy security, Carsten Poppinga, chief commercial officer at Uniper, tells Petroleum Economist

20 February 2026

Sempra Infrastructure’s vice president for marketing and commercial development, Carlos de la Vega, outlines progress across the company’s US Gulf Coast and Mexico Pacific Coast LNG portfolio, including construction at Port Arthur LNG, continued strong performance at Cameron LNG and development of ECA LNG

19 February 2026

US LNG exporter Cheniere Energy has grown its business rapidly since exporting its first cargo a decade ago. But Chief Commercial Officer Anatol Feygin tells Petroleum Economist that, as in the past, the company’s future expansion plans are anchored by high levels of contracted offtake, supporting predictable returns on investment