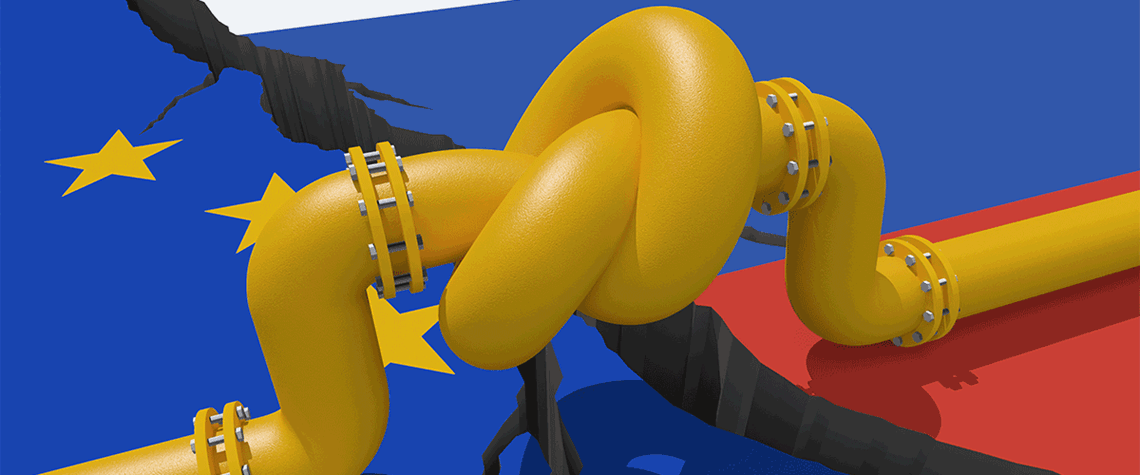

Global gas market reawakened by ‘Russia effect’

Industry takes fresh look at moribund, risky or questionable gas and LNG projects

The ‘Structures A and E’ project off the Libyan coast is as prosaic as its name implies, holding an unspectacular 6tn ft³ (170bn m³) of gas. Plans to extract it date from 2008, but the operator, Italy’s Eni, had been content to leave it in the ground given the upheaval in Libya. That upheaval has not gone away: the country has two rival governments, militias rule the capital and its National Oil Corporation is riven with infighting. But in January, Eni cast those worries aside and announced it was developing Structures A and E. One big reason is the ‘Russia effect’—Europe’s thirst for new gas following the imposition of sanctions on Moscow. Russia supplied half of Europe’s gas before its inv

Also in this section

17 February 2026

The 25th WPC Energy Congress, taking place in Riyadh, Saudi Arabia from 26–30 April 2026, will bring together leaders from the political, industrial, financial and technology sectors under the unifying theme “Pathways to an Energy Future for All”

17 February 2026

Siemens Energy has been active in the Kingdom for nearly a century, evolving over that time from a project-based foreign supplier to a locally operating multi-national company with its own domestic supply chain and workforce

17 February 2026

Eni’s chief operating officer for global natural resources, Guido Brusco, takes stock of the company’s key achievements over the past year, and what differentiates its strategy from those of its peers in the LNG sector and beyond

16 February 2026

As the third wave of global LNG arrives, Wood Mackenzie’s director for Europe gas and LNG, Tom Marzec-Manser, discusses with Petroleum Economist the outlook for Europe’s gas market in 2026