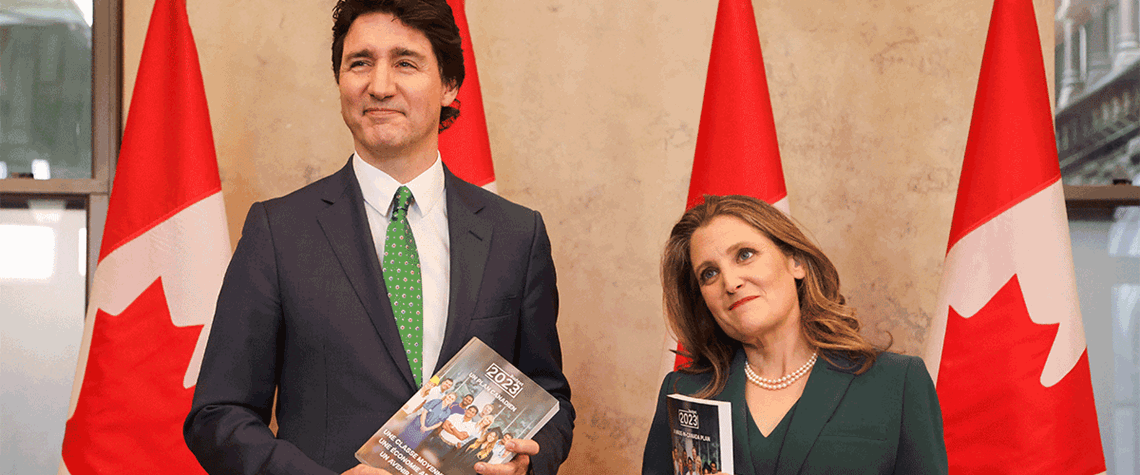

Canada unveils hydrogen investment tax credit

Projects seeking full rate must have carbon intensity below 4kg of CO₂/kg of hydrogen produced and meet labour requirements

Canada has included an investment tax credit for hydrogen production based on lifecycle carbon intensity in its 2023 federal budget. The maximum support covers 40pc of eligible project costs if carbon intensity is below 0.75kg of CO₂/kg of hydrogen produced, while the minimum covers 15pc of costs for projects with carbon intensity 2–4kg of CO₂/kg of hydrogen produced. Canada plans to calculate carbon intensity on a ‘cradle-to-gate’ basis, accounting for upstream emissions through to the point hydrogen exits the facility. As hydrogen is a zero-carbon gas, downstream emissions after production will not be considered, the government says. Projects converting low-carbon hydrogen to ammonia would

Also in this section

22 October 2024

Hydrogen is making inroads as a fuel for power plants as governments seek clean fuels to back up intermittent wind and solar

21 October 2024

Gulf Energy Information will host the largest women's event in the energy industry on 19–20 November in Houston, Texas

18 October 2024

Project in northeast of country set to start up in 2025 as developer signs technology deal with Icelandic firm Carbon Recycling International

17 October 2024

Experts debate carbon pricing and fossil fuel subsidies in the MENA region on second day of summit