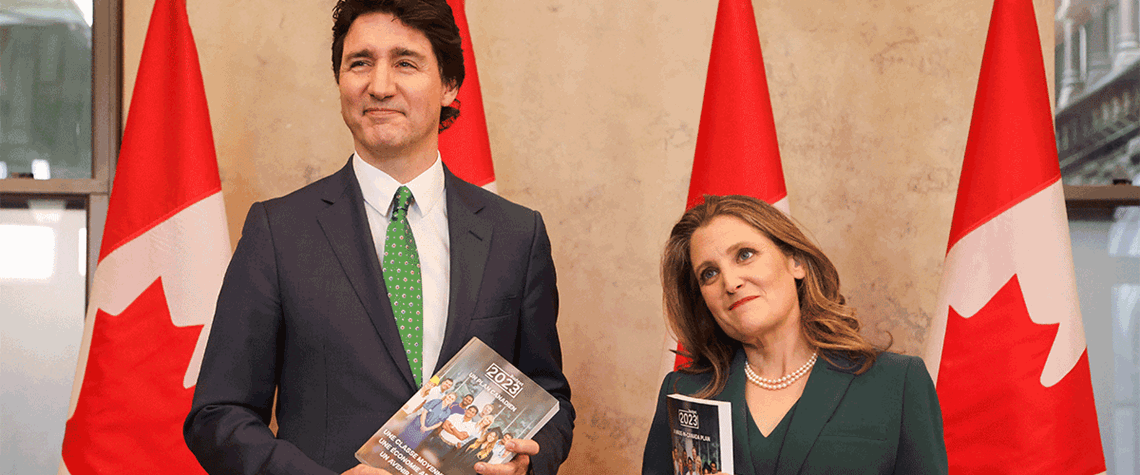

Canada unveils hydrogen investment tax credit

Projects seeking full rate must have carbon intensity below 4kg of CO₂/kg of hydrogen produced and meet labour requirements

Canada has included an investment tax credit for hydrogen production based on lifecycle carbon intensity in its 2023 federal budget. The maximum support covers 40pc of eligible project costs if carbon intensity is below 0.75kg of CO₂/kg of hydrogen produced, while the minimum covers 15pc of costs for projects with carbon intensity 2–4kg of CO₂/kg of hydrogen produced. Canada plans to calculate carbon intensity on a ‘cradle-to-gate’ basis, accounting for upstream emissions through to the point hydrogen exits the facility. As hydrogen is a zero-carbon gas, downstream emissions after production will not be considered, the government says. Projects converting low-carbon hydrogen to ammonia would

Also in this section

9 March 2026

Hydrogen has not stalled in the UK because the technology does not work. The problem is that the system around it does not yet move at the speed required

4 March 2026

Turmoil in Middle East reminds nascent clean hydrogen sector that its future prospects are dependent on global energy markets and geopolitics

25 February 2026

Low-carbon hydrogen and ammonia development is advancing much more slowly and unevenly than once expected, with high costs and policy uncertainty thinning investment. Meanwhile, surging energy demand is reinforcing the role of natural gas and LNG as the backbone of the global energy system, panellists at LNG2026 said

18 February 2026

Norwegian energy company has dropped a major hydrogen project and paused its CCS expansion plans as demand fails to materialise