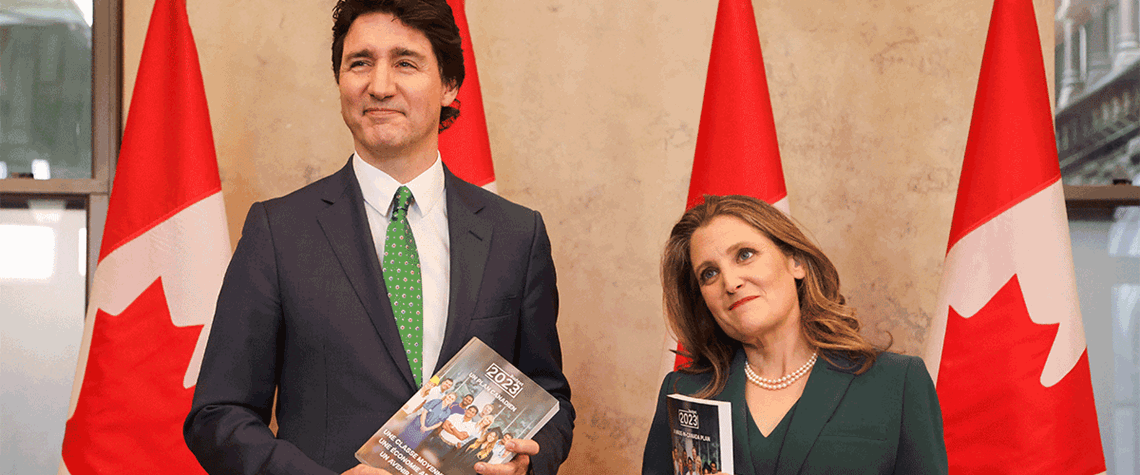

Canada unveils hydrogen investment tax credit

Projects seeking full rate must have carbon intensity below 4kg of CO₂/kg of hydrogen produced and meet labour requirements

Canada has included an investment tax credit for hydrogen production based on lifecycle carbon intensity in its 2023 federal budget. The maximum support covers 40pc of eligible project costs if carbon intensity is below 0.75kg of CO₂/kg of hydrogen produced, while the minimum covers 15pc of costs for projects with carbon intensity 2–4kg of CO₂/kg of hydrogen produced. Canada plans to calculate carbon intensity on a ‘cradle-to-gate’ basis, accounting for upstream emissions through to the point hydrogen exits the facility. As hydrogen is a zero-carbon gas, downstream emissions after production will not be considered, the government says. Projects converting low-carbon hydrogen to ammonia would

Also in this section

4 February 2026

Europe’s largest electrolyser manufacturers are losing patience with policymakers as sluggish growth in the green hydrogen sector undermines their decision to expand production capacity

2 February 2026

As a fertiliser feedstock, it is indispensable, but ammonia’s potential as a carbon-free energy carrier is also making it central to global decarbonisation strategies

28 January 2026

The development of hydrogen’s distribution system must speed up if the industry is to stand any chance of grabbing a meaningful slice of the low-carbon energy market

14 January 2026

Continent’s governments must seize the green hydrogen opportunity by refining policies and ramping up the development of supply chains and infrastructure