Jera picks Yara and CF as potential ammonia suppliers

The Japanese energy firm has selected possible providers of low-carbon ammonia for co-firing at its Hekinan thermal power plant

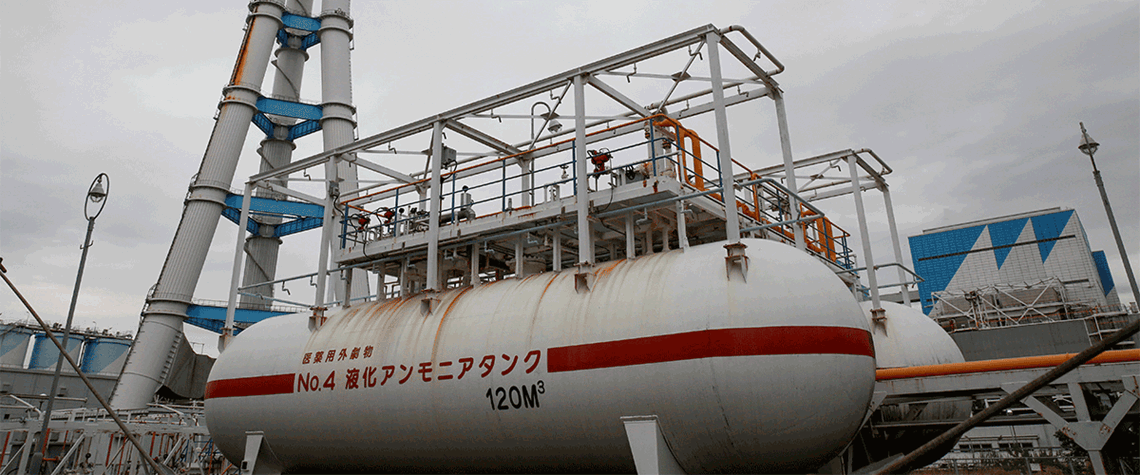

Japanese energy firm Jera has chosen chemicals giants Yara and CF Industries as potential suppliers for its planned coal-ammonia co-firing unit at its Hekinan thermal power plant. Jera opened a call in February for low-carbon ammonia suppliers for Hekinan’s Unit 4, which will require 500,000t/yr of the fuel for co-firing at a 20/80 ratio with coal from 2027. The firm had concluded a co-firing pilot test in 2022 and plans to begin a further large-volume demonstration project at Hekinan from the end of 2023 to the beginning of 2024. Jera specifies that ammonia provided for co-firing must be produced with 60pc lower carbon emissions than conventionally produced ammonia. Under a memorandum of un

Also in this section

22 October 2024

Hydrogen is making inroads as a fuel for power plants as governments seek clean fuels to back up intermittent wind and solar

21 October 2024

Gulf Energy Information will host the largest women's event in the energy industry on 19–20 November in Houston, Texas

18 October 2024

Project in northeast of country set to start up in 2025 as developer signs technology deal with Icelandic firm Carbon Recycling International

17 October 2024

Experts debate carbon pricing and fossil fuel subsidies in the MENA region on second day of summit