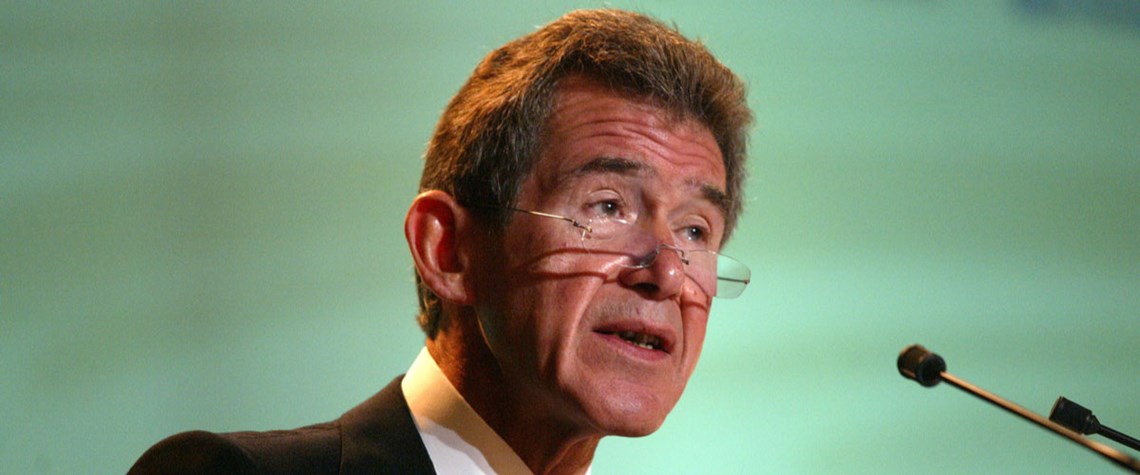

Transition investment falling short – Browne

Annual investment only about a third of required levels as risks deter investors, say former BP chief and chair of Beyondnetzero

Investment in the energy transition is languishing at only about a third of the level needed for it to succeed and looks unlikely to accelerate in the near term, former BP CEO John Browne told the FT’s Energy Transition Summit today. Browne, who now chairs Beyondnetzero, a climate growth equity venture managed together with US private equity firm General Atlantic, says capital should be flowing into the transition at a rate of at least $3.5tn/yr to meet the world’s climate goals. But it is falling short of that level for reasons that include commercial risk, technological readiness and infrastructure capability. “I want this transition to take place, but it needs a lot of investment, and th

Also in this section

21 July 2024

Awards experience 20% increase in nominations this year, with submissions from 27 countries

18 July 2024

Platform developed at Scottish university uses advanced simulations and machine learning to find most cost-effective and sustainable combinations of materials for use in carbon capture

18 July 2024

Stockholm Exergi agrees to one of world’s largest deployments of CO₂ liquefication technology to enable transport of emissions captured from biomass power plant

11 July 2024

Watkins will leverage her financial acumen and strategic insight to lead Gulf’s commercial initiatives across media, events, and market intelligence