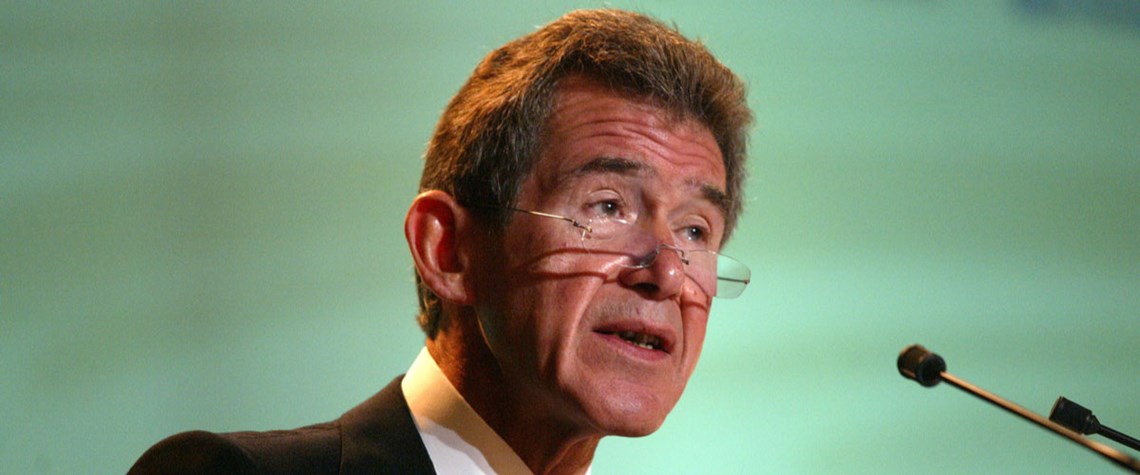

Transition investment falling short – Browne

Annual investment only about a third of required levels as risks deter investors, say former BP chief and chair of Beyondnetzero

Investment in the energy transition is languishing at only about a third of the level needed for it to succeed and looks unlikely to accelerate in the near term, former BP CEO John Browne told the FT’s Energy Transition Summit today. Browne, who now chairs Beyondnetzero, a climate growth equity venture managed together with US private equity firm General Atlantic, says capital should be flowing into the transition at a rate of at least $3.5tn/yr to meet the world’s climate goals. But it is falling short of that level for reasons that include commercial risk, technological readiness and infrastructure capability. “I want this transition to take place, but it needs a lot of investment, and th

Also in this section

10 March 2026

Europe urgently needs to bring more projects to FID, as CCS investors warn they might divert capital to faster-growing regions

9 January 2026

A shift in perspective is needed on the carbon challenge, the success of which will determine the speed and extent of emissions cuts and how industries adapt to the new environment

2 January 2026

This year may be a defining one for carbon capture, utilisation and storage in the US, despite the institutional uncertainty

23 December 2025

Legislative reform in Germany sets the stage for commercial carbon capture and transport at a national level, while the UK has already seen financial close on major CCS clusters