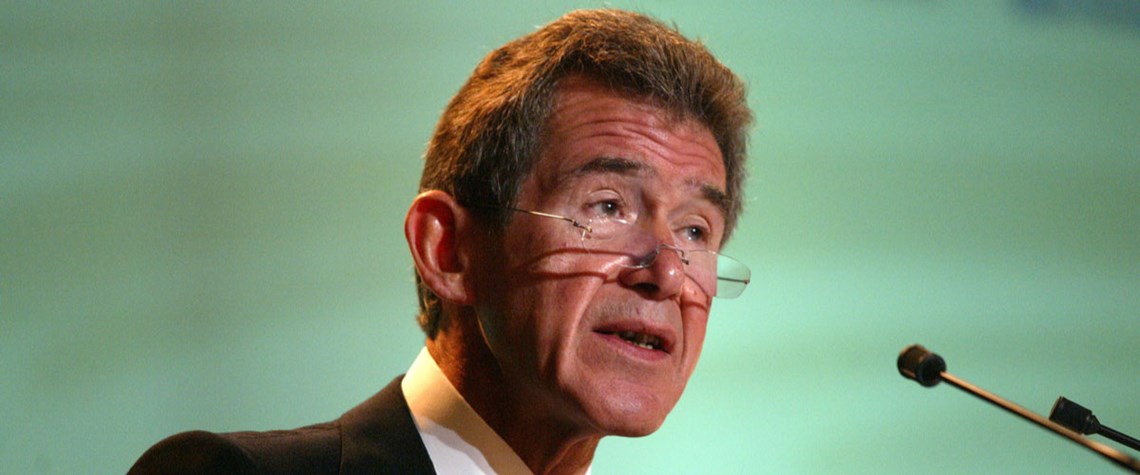

Oil firms should separate fossil and low-carbon businesses – Browne

World undergoing disorderly energy transition that could be delayed by spiking fossil fuel prices, says former BP CEO John Browne

Oil and gas companies should take bolder steps to separate their low-carbon and fossil fuel businesses, former BP CEO John Browne told an energy event today. Browne, who now chairs US private equity firm General Atlantic’s climate venture Beyond Netzero, says a separation of the businesses would give clarity on companies’ commitment to renewables, especially when high prices offer better returns from investment in fossil fuels. “When oil prices were last at $100/bl, oil companies diverted capital away from their nascent renewable energy businesses and actually put it back to work in hydrocarbons in pursuit of return. They maintained a rhetorical commitment to renewables but, in practice, did

Also in this section

9 January 2026

A shift in perspective is needed on the carbon challenge, the success of which will determine the speed and extent of emissions cuts and how industries adapt to the new environment

2 January 2026

This year may be a defining one for carbon capture, utilisation and storage in the US, despite the institutional uncertainty

23 December 2025

Legislative reform in Germany sets the stage for commercial carbon capture and transport at a national level, while the UK has already seen financial close on major CCS clusters

15 December 2025

Net zero is not the problem for the UK’s power system. The real issue is with an outdated market design in desperate need of modernisation