2023 saw the imperative to address climate change become more urgent. More frequent and extreme weather events around the world dominated the news. The world’s September 2023 temperatures were the warmest on record, shocking climate scientists. Yet, even as climate change accelerates, significant progress is being made in decarbonisation.

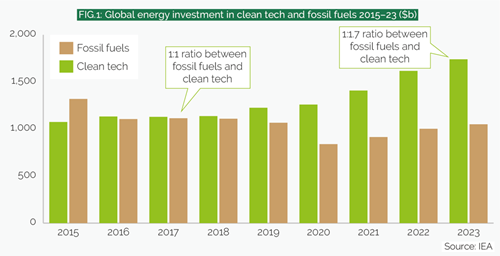

Global spend in clean energy technology reached $1.7t in 2023, up more than 40% on 2019 and outpacing investment in fossil fuels by a factor of nearly two (see Fig.1). The G20 countries committed to tripling renewables output by 2030. Electric vehicles are proliferating, accounting for 18% of all new car sales globally in 2023 versus less than 5% in 2020. Political consensus across party divides in many regions will advance policy and funding to support clean energy technologies and the energy transition. The US’s Inflation Reduction Act is a case in point, where it has attracted over $200b of clean energy technology investment, tripling in total since 2018.

Difficult environment

Despite this progress, significant challenges lie ahead. The business environment is getting tougher to navigate, with cost inflation, high interest rates and supply chain challenges. This will have an adverse impact on the pipeline of low-carbon projects, where upfront capital expenditure is high. Some of this distress is already manifesting itself in the offshore wind sector, which is seen as the backbone of future power generation.

There is also an emerging narrative around the affordability of the transition. The UK government’s decision to defer the internal combustion engine ban to 2035, as well as soften ambitions in decarbonising heat, reflect the political sensitivity of asking consumers to incur more costs during a cost-of-living crisis. We may see other governments reacting in a similar way.

As for decarbonisation across the business sector, there is a sense that the easier initiatives are already being tackled and the harder challenges remain. Addressing supply chain emissions is a good example of more complex decarbonising efforts. Other companies in heavy industry also acknowledge that carbon abatement technology is simply not available to help them meet their interim emissions targets.

So, looking ahead to 2024, what should governments and business do?

Standing by back commitments

Governments need to sustain their decarbonisation ambitions. Rowing back on commitments will send the wrong message to consumers and business. Inevitably it will get harder for governments to juggle affordability with political support from voters, especially when tackling more complex decarbonisation themes such as heating. Softening net-zero policies now to avoid short-term costs will only increase long-term costs to consumers and ultimately the planet.

Governments will also need to ensure regulatory continuity and avoid diluting their net-zero pledges and maintain commitments to develop technology. Businesses need long-term stability to deploy significant capital and the regulatory environment must facilitate that spend by instilling confidence that there is predictability.

As for businesses, they will need to be more selective and focused with regards to decarbonisation initiatives. Companies with a large pipeline of low-carbon projects will need to focus on those projects where the economics and returns make most sense. For example, hydrogen production projects that have integrated value chain plays, such as providing a feedstock for “green steel”, will help de-risk projects and improve project feasibility.

Delivering these projects will also require an enhanced focus on the workforce capable of doing so and the communities that will be impacted by these initiatives. A people-centric energy transition is imperative. It is worth noting that the bottleneck in capabilities to deliver the transition is not widely recognised and will need to be a focal point going forward.

With regards to decarbonising supply chains, this will remain a major focus for business. Achieving this will require close collaboration between companies and their respective supply chains. Businesses will need to figure out where to target their efforts for the best possible returns. For example, where there are strong regulatory forces already shaping aspects of the supply chain, such as transportation decarbonisation, this may require less attention. Instead, companies may be better advised to focus efforts on elements of the supply chain where there is currently no major regulatory driver to decarbonise. Think for example of a train operator looking at heat decarbonisation opportunities in its network, or a food producer sourcing raw materials from agricultural suppliers, where sustainability measures are not yet embedded in the industry.

More broadly, partnerships are and will be critical to accelerating the energy transition. These may be public-private, such as the US government using tax credits and loans to attract private capital, as illustrated by the Inflation Reduction Act. More saliently, consider how since COP26, business is taking a leadership role alongside governments to accelerate decarbonisation. Then there are the partnerships evolving between companies that will be essential to decarbonise their respective supply chains.

With cost inflation and high interest rates likely to shape 2024 and make it a challenging operating environment, net zero must remain the North Star of government and industry alike. There is a real sense in many regions that the partnership between the public and private sector is accelerating the transformation of our energy system. That momentum must be maintained.

Jennifer Obertino is senior vice-president, global energy practice leader, at AECOM. Adrian Del Maestro is vice-president, global energy advisory, at AECOM

For more on how to navigate the energy transition with practical, profitable, predictable and people-centric strategies to achieve net zero, please see AECOM’s latest global research report, Lost in transition?, available at: https://infrastructure.aecom.com/

This article was published as part of PE Outlook 2024, which is available for subscribers here. Non-subscribers can purchase a copy of the digital edition here.

Comments