UK opens £120mn nuclear fund

Fund aims to kickstart projects and attract private investment

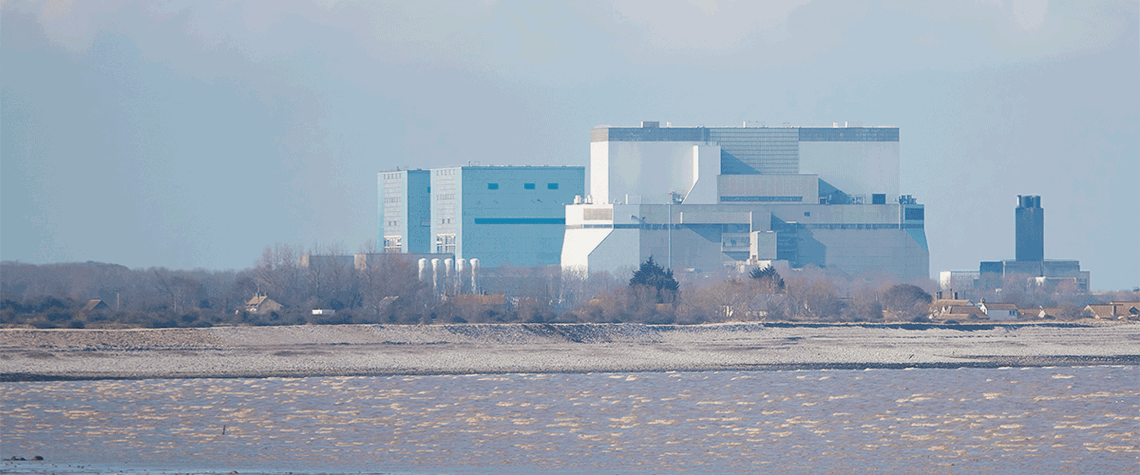

The UK has opened its £120mn ($146mn) Future Nuclear Enabling Fund, which aims to support the government’s ambition to approve eight new reactors this decade. The fund will provide targeted, competitively allocated grants for the construction of projects—including small modular reactors. “Our new £120mn fund will push forward our plan to deploy a new fleet of nuclear power stations as part of a British nuclear renaissance,” says UK business and energy minister Kwasi Kwarteng. Nuclear forms a key part of the UK energy security strategy released last month. The government aims to reach 24GW of nuclear capacity by 2050—accounting for 25pc of projected energy demand by that year. But while the g

Also in this section

28 March 2025

The massive expansion of the Northern Lights project in Norway is the clearest sign yet that the European oil and gas companies mean business when it comes to CCS

27 March 2025

Awards celebrate global innovation, leadership and achievement across the energy sector’s people, projects, technologies and companies.

20 March 2025

While advanced economies debate peak fossil fuel demand, billions of people still lack access to reliable and affordable energy, especially in the Global South

14 March 2025

Ignoring questions of sustainability will not make the problems they focus on go away