Broker launches insurance against carbon leakage

London-based Howden says new product can boost bankability of CCS projects by addressing key risk

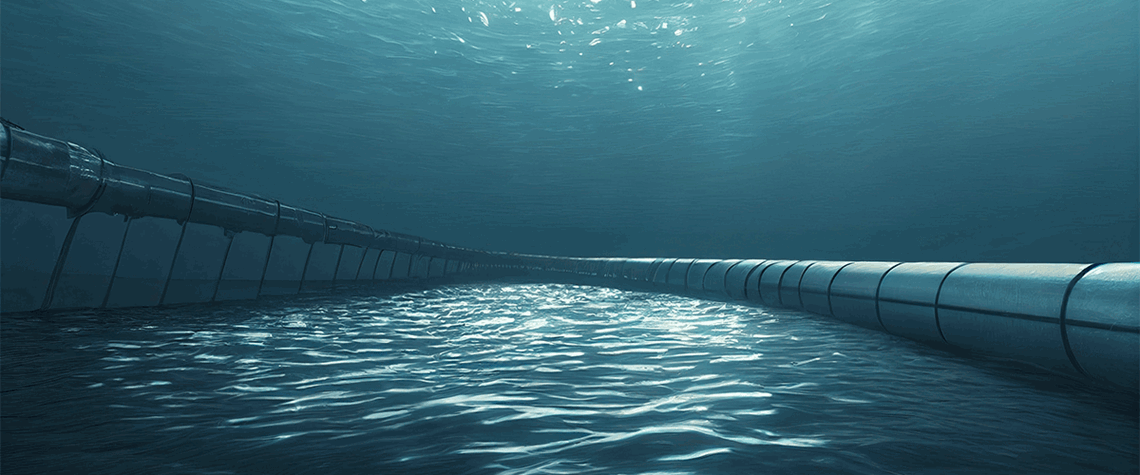

London-based broker Howden has launched an insurance facility covering leakage of CO₂ from commercial-scale CCS projects in a move designed to help unlock investment by addressing one of the sector’s key risks. The insurance facility, which Howden says is the first of its type, provides cover for environmental damage and loss of revenue arising from the sudden or gradual leakage of CO₂ from CCS projects into the air, land and water. Leakage could lead to CCS projects being unable to fulfil emission reduction commitments made against offsets or allowances issued in cap-and-trade markets. The insurance product is also designed to support the development of a commercial insurance market for lea

Also in this section

9 January 2026

A shift in perspective is needed on the carbon challenge, the success of which will determine the speed and extent of emissions cuts and how industries adapt to the new environment

2 January 2026

This year may be a defining one for carbon capture, utilisation and storage in the US, despite the institutional uncertainty

23 December 2025

Legislative reform in Germany sets the stage for commercial carbon capture and transport at a national level, while the UK has already seen financial close on major CCS clusters

15 December 2025

Net zero is not the problem for the UK’s power system. The real issue is with an outdated market design in desperate need of modernisation