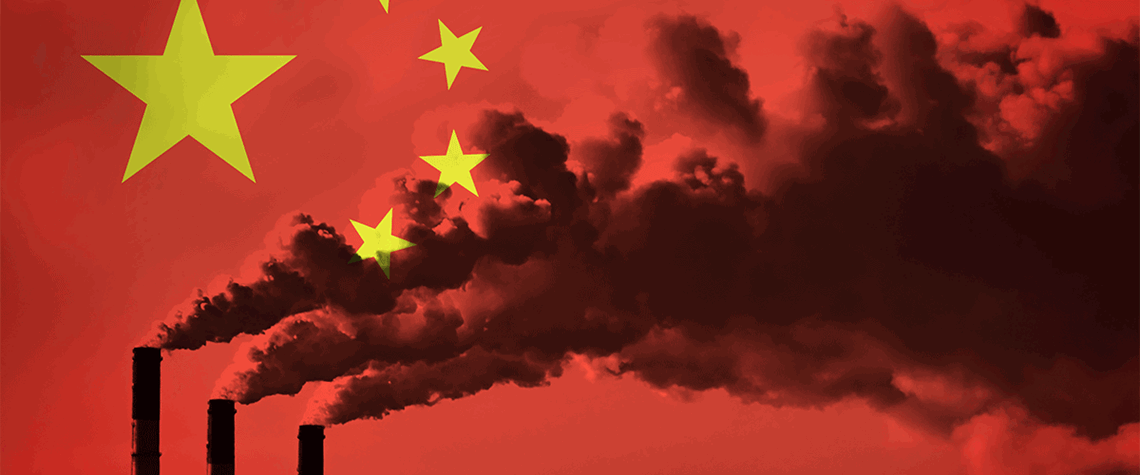

China’s emissions trading scheme lacks bite

Overly generous allowance allocations and low prices blunt impact of world’s largest cap-and-trade scheme in its first 18 months

China’s cap-and-trade scheme has so far struggled to make an impact on emissions from domestic thermal power generators—the only sector it covers—because of low prices and overly generous allowance allocations. China’s emissions trading system (ETS) went live in July 2021 after years of delays and six regional pilots in cities including Beijing and Shanghai. It covers 2,162 thermal power plants that each emit at least 26,000t of CO₂/yr. The scheme, overseen by the state-owned Shanghai Environmental and Energy Exchange (SEEE), covers c.4.5bn t/yr of CO₂ emissions, making it the biggest in the world by volume. But transaction value in its first year of operation reached just RMB8.5bn ($1.22bn)

Also in this section

9 January 2026

A shift in perspective is needed on the carbon challenge, the success of which will determine the speed and extent of emissions cuts and how industries adapt to the new environment

2 January 2026

This year may be a defining one for carbon capture, utilisation and storage in the US, despite the institutional uncertainty

23 December 2025

Legislative reform in Germany sets the stage for commercial carbon capture and transport at a national level, while the UK has already seen financial close on major CCS clusters

15 December 2025

Net zero is not the problem for the UK’s power system. The real issue is with an outdated market design in desperate need of modernisation